How the Accounting Equation Works

The accounting equation helps investors and business owners understand how the company is performing. The one statement that fundamentally uses this equation is the balance sheet. Warren Buffett prefers analyzing the balance sheet first because he believes it’s harder for companies to hide information there. By contrast, most investors focus on the income statement.

Buffett did say you can’t get the full picture from either the balance sheet or the income statement, but he feels the balance sheet can offer great insights without management trying to cover up situations that aren’t so groovy (my words, not his).

Most investors should read and understand the balance sheet as part of their analysis anyway. After all, it is the financial statement that defines the accounting equation, as mentioned, which is fundamental for showing how companies are faring in the business world.

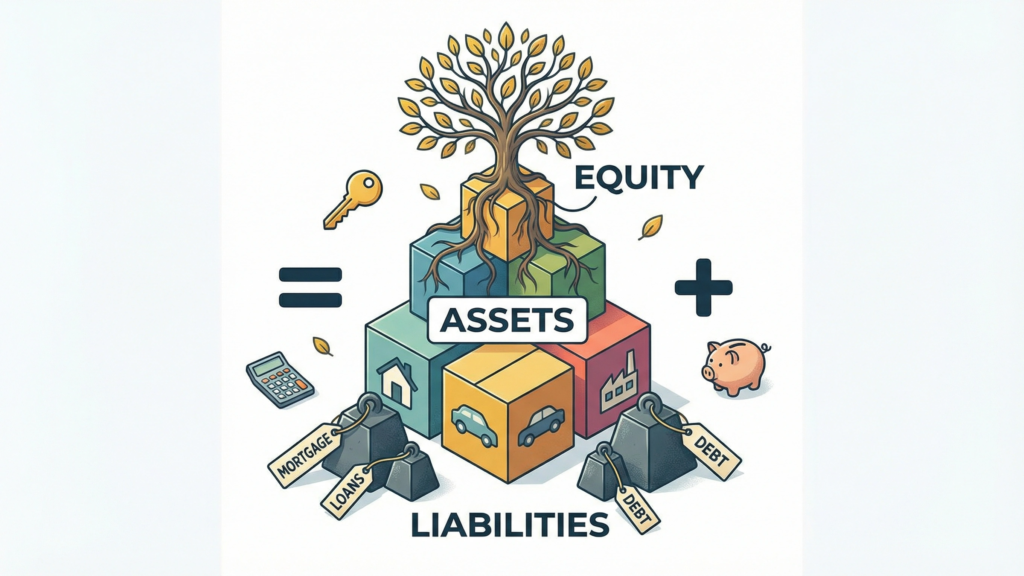

The Accounting Equation

Shareholders’ Equity = Assets – Liabilities

This makes sense because assets are what you own, and liabilities are what you owe. When you subtract out the liabilities, you are left with equity.

We can rearrange the equation such that Assets = Shareholders’ Equity + Liabilities. This format is the official one for accounting.

I had a difficult time understanding this earlier in my career. It’s not that the equation itself is complicated. Hardly so. I just couldn’t understand what it meant from a pure numbers perspective. I think the problem was that I didn’t really grasp the meaning of the terms themselves. Assets, Liabilities, Equity? What do the numbers represent?

Then I saw an example of how you can relate the accounting equation to homeownership, and it was an Aha! moment for me. For easy numbers, let’s assume you are considering purchasing a home for $100,000 (wishful thinking, I know!) Most lenders will require you to plunk down 20%, so in our example, this amount would be $20,000 (20% of $100,000).

Before we do that, though, let’s understand the definitions:

Assets = what you own

Liabilities = what you owe

Equity = what’s leftover

Back to our scenario – Let’s spell out each component:

Assets = $100,000 (the value of the home)

Liabilities = $80,000 (the remainder of the loan after the $20,000 down)

Equity = $20,000 (your down payment)

Applying the accounting equation:

$100,000 = $80,000 + $20,000

Assets Drive Business Growth

Companies need assets to make money. They purchase the assets with the expectation of transforming them into viable products that consumers purchase. The key to the accounting equation is to understand how those assets are purchased. Either the company can borrow money to purchase them, or it can use its equity to make the purchase. Sometimes it can be a combination of the two. Nonetheless, the grand total of assets equals the sum of liabilities and equity.

By staying focused on how the assets are funded, you should be able to understand the equation (hopefully faster than I did initially). If it’s still not clear, just think about the homeowner analogy.

It should be noted that not all assets a business purchases will generate worthwhile returns for the company. Some assets, such as rent (a prepaid expense), are non-revenue-generating assets, which are required for the business to operate. Companies can also hold excess cash, which prevents them from allocating capital to investments that would maximize returns.

Understanding the accounting equation prepares you to better understand the balance sheet. In fact, it’s called a balance sheet because the Assets must equal the Liabilities + Shareholders’ Equity.