Understanding the Income Statement: A Beginner’s Guide

Meta Description (SEO):

Learn the basics of the income statement in this beginner-friendly guide. Understand revenues, expenses, gross profit, EBITDA, and the “bottom line” with simple explanations and examples.

Related: Already know about the income statement? Jump right to the quiz.

Introduction

If you’ve ever wondered how businesses measure their profitability, the income statement is where to look. This financial report, sometimes called the profit and loss (P&L) statement, tracks a company’s revenues, expenses, and net income over a given time period.

Whether you’re a student, a new investor, or simply curious about financial statements, this guide breaks down the essentials of the income statement in plain English. By the end, you’ll know how to read one, what to focus on, and how the key terms connect to real-world performance.

1. What Is an Income Statement?

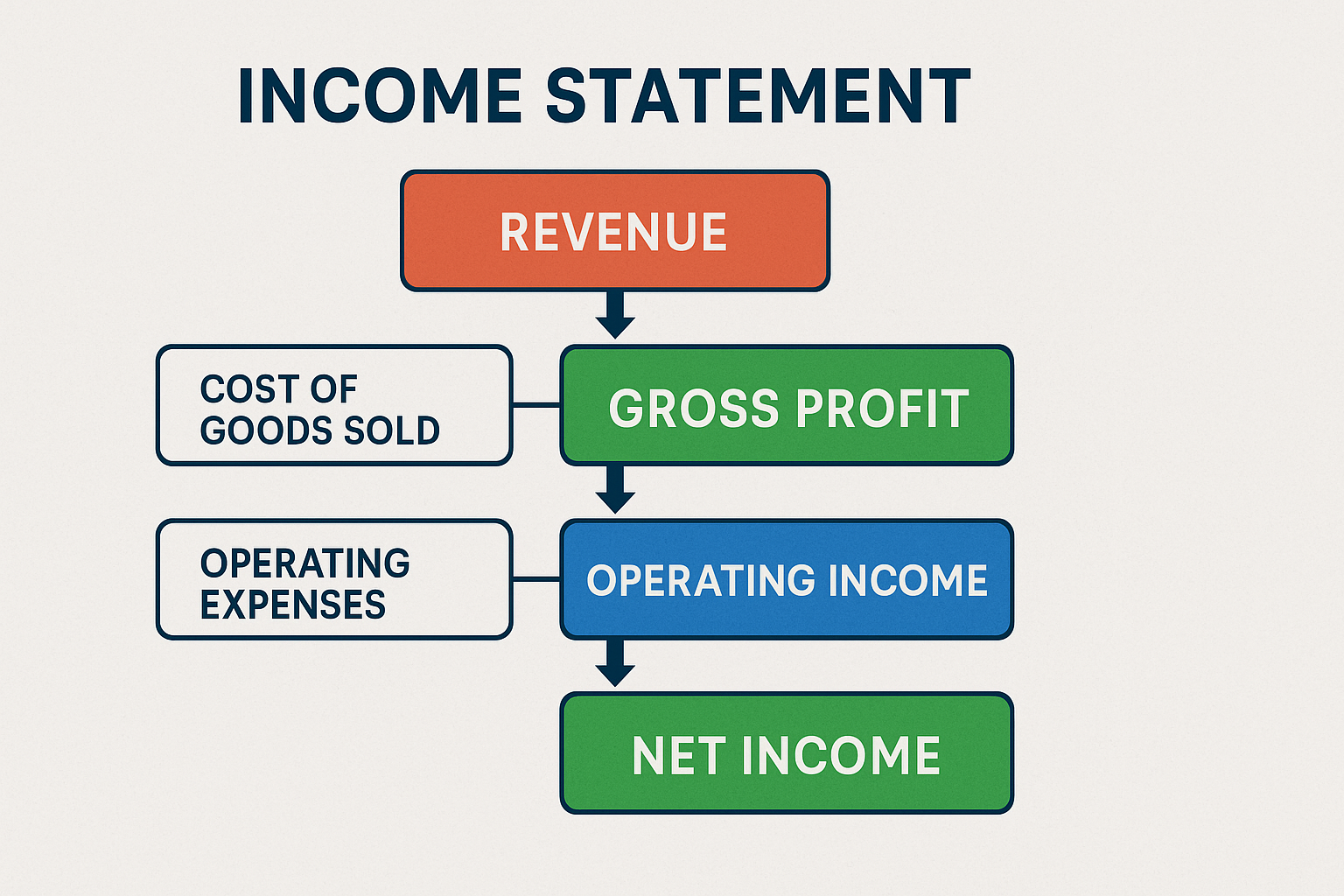

The income statement shows revenues and expenses over a period of time (monthly, quarterly, or annually). Unlike the balance sheet, which captures a single moment in time, the income statement tells a story — how money was made and spent throughout the period.

2. Gross Profit

Gross Profit = Revenue – Cost of Goods Sold (COGS)

This figure shows how much is left after covering the direct costs of producing goods or services. It’s a measure of how efficiently the company produces and sells its core offerings before accounting for overhead like rent, salaries, or marketing.

3. What You Won’t Find on an Income Statement

Not every financial number belongs here. Accounts Receivable, for example, is an asset and appears on the balance sheet, not the income statement.

Instead, the income statement includes items like:

- Depreciation expense

- Rent expense

- Interest expense

4. The Bottom Line: Net Income

When people say “the bottom line,” they mean Net Income. This is the profit left after subtracting all operating expenses, interest, and taxes. It tells you whether the company made or lost money during the reporting period.

5. Operating vs. Non-Operating Items

The income statement separates what comes from regular business operations versus other activities:

- Operating items: sales revenue, cost of goods sold, wages, rent.

- Non-operating items: interest expense or investment gains/losses.

6. What Is EBITDA?

EBITDA = Earnings Before Interest, Taxes, Depreciation, and Amortization

This measure strips away financing costs and accounting adjustments, giving a clearer picture of a company’s operating performance. It’s often used in valuation and comparison across companies.

7. Single-Step vs. Multi-Step Income Statements

There are two formats you’ll see:

- Single-step: adds up all revenues, subtracts all expenses in one calculation.

- Multi-step: separates operating from non-operating sections, showing subtotals like gross profit and operating income.

Larger companies usually prefer the multi-step version for clarity.

8. What Appears Before Net Income?

Nearly every income statement lists Income Tax Expense right before net income. Taxes are deducted last, leaving the final “bottom line.”

9. Extraordinary Items (Historical Note)

Once upon a time, companies reported extraordinary items separately — unusual and infrequent events such as natural disasters. Today, under both IFRS and U.S. GAAP, these are no longer broken out. They’re included in net income like everything else.

10. What Increases Net Income?

The simplest answer: higher revenues.

If expenses stay flat while revenue grows, net income rises. On the flip side, increases in expenses, taxes, or interest costs reduce net income.

Conclusion

The income statement is one of the three core financial statements every investor or business owner should understand. It reveals how a company generates revenue, controls costs, and ultimately produces profit.

By learning terms like gross profit, EBITDA, and net income, you’ll have the tools to analyze business performance with confidence.