Do You Like Stable Companies?

Here's a question for you. Which would you rather have - a company that grows its revenues by 15% or a company that grows its revenues by 15%? Seems like a trick question, doesn't it? However, when I describe below why these two companies are different, it will shed light on an important concept in finance. I will ask the same question as the title of this article - do you like stable companies?

Obviously, there is more to the picture in this the scenario than the information I provided. Two companies that both grow their revenues by 15% in the same time period may not be equal. What if I told you that one company has volatility of 45% and the other has volatility of 12%?

Suddenly, you are faced with the prospect of dealing with the risk of each company. That is what volatility measures. Here is yet another question: why would you spend money on a company with 45% volatility that generates the same revenue growth as a company with 12% volatility?

This example doesn't factor in the stock prices of these companies. It's likely that the stock with higher volatility is going to trade higher, all equal. Putting that aside though, if you saw the stock prices of these two companies, the one with the stable growth has a larger chance of having stable stock price growth. The chart of a stock with erratic revenues are likely to be all over the place.

Which Is Preferable?

Maybe you don't mind the risk of an unstable company. After all, you have a chance at increasing your stock by a significant amount. But most people never factor in the other side - when the stock takes a huge hit to the downside. Volatile stocks tend to have up and down spurts that can make it tough to sleep at night.

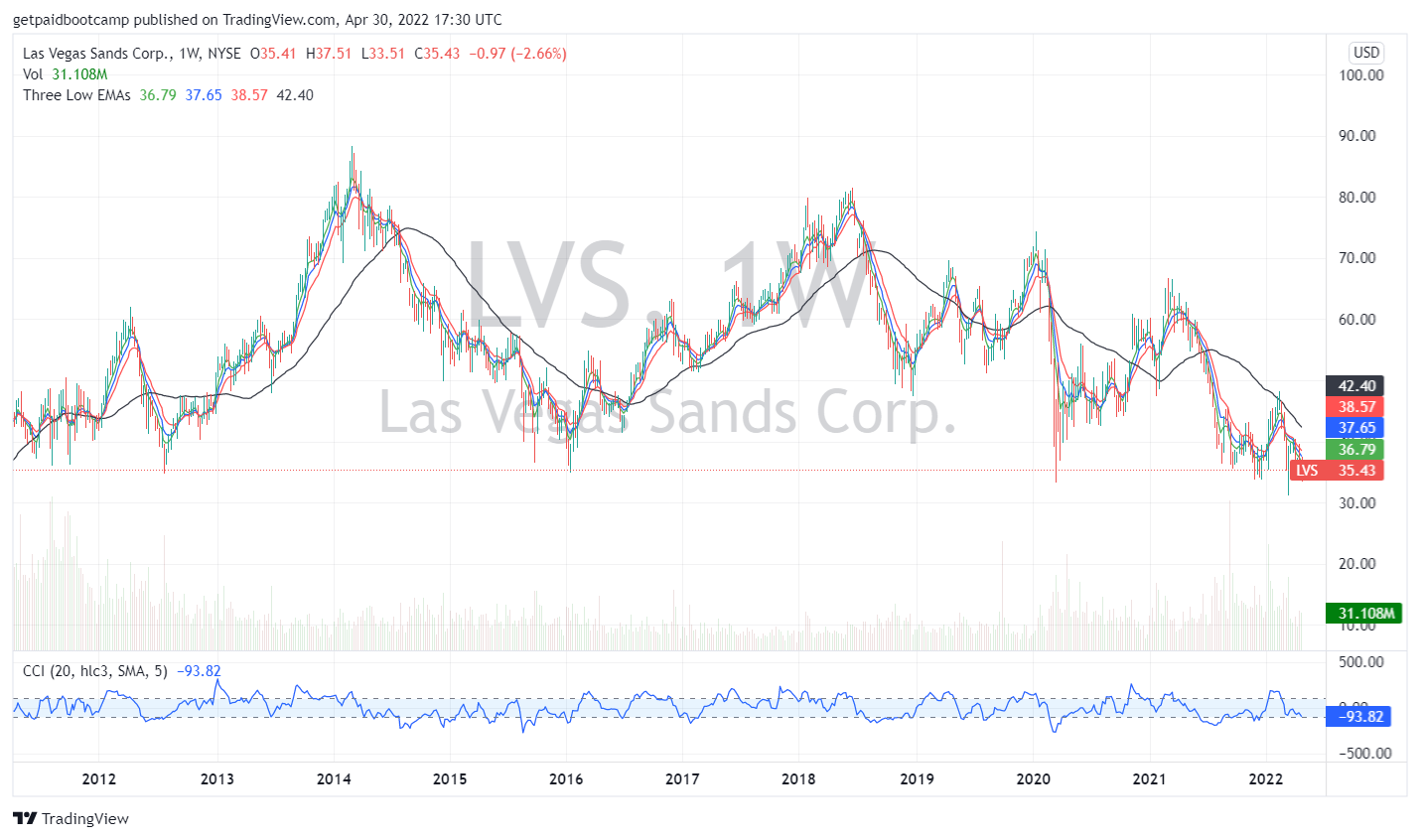

Take a look at the following stock chart:

What are your thoughts about this company? Do you think the prices of this stock are relatively stable?

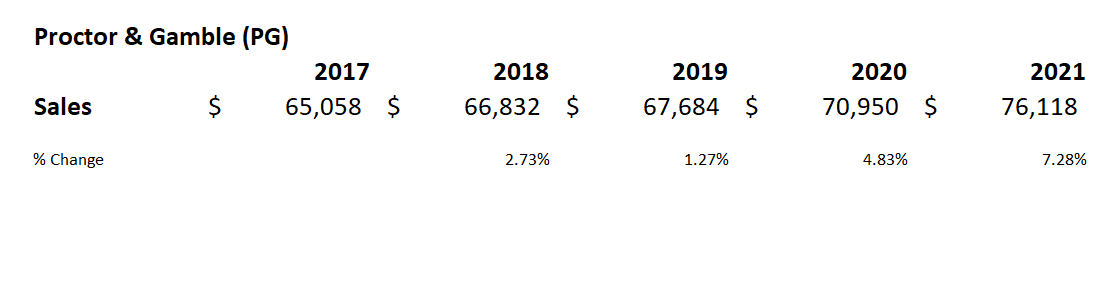

What about this company?

I don't know about you, but that first chart makes me feel a bit more warm and cozy with my hard earned money.

Now, just looking at stock charts is not enough to make a determination about a company. Proctor & Gamble is a stable company, but it doesn't mean it's the right investment for you. It may well be. But there is more to the story and the hypothesis than just looking at the price charts.

One caveat: a stock chart of a company like Las Vegas Sands may prompt you to take a pass on the company. In other words, who needs that stress by including a stock like this in your portfolio?

Stable Sales (Revenues)

As a starting point in your investment research, opt for companies that generate stable sales. Obviously, there is a lot more to the research landscape than just sales. But if the sales story isn't good for several periods, why continue with your analysis?

You can find sales-data on many websites. But sites offering free access to data probably only provide three years' worth of data. That isn't going to be enough to establish a trend. Therefore, you may need to hit up the Securities and Exchange Commission's (SEC) website. Every public company must file financial reports with the SEC. The SEC makes this information available for free on its website.

Since we're talking about Proctor & Gamble (PG), let's take a look at the last five years of revenues for the company:

Data courtesy of SEC.gov.

Since 2017, revenues have a track record of growing. While 2019 was as stellar as the other years, the growth was still positive.

Should Every Year Be Positive?

Is it possible for companies to be solid performers and still have an off year or two? Yes. You have to decide on how much of a stickler you want to be. It's perfectly valid to choose only companies that have positive sales growth and never deal with companies that experience a bad year. But you may be missing on significant opportunities if that is your criterion. Business isn't perfect and it's rare to find companies that can generate solid sales growth throughout its history.

You'll need to use your judgment about what constitutes too many negative periods of sales growth. It's wise to insist on a majority towards the plus side. But what constitutes a comfortable majority (8 out of 10, 7 out of 10, etc.) is somewhat subjective.

Continue Your Research

Measuring sales is an important tool for company research. But companies can have solid sales growth, but other measures may show weakness. For instance, a highly leveraged (in-debt) company will have to spend a good chunk of its cash flow towards paying down its debt. The sales may be good, but when you get to the bottom line (net income), there's nothing left for growth or investors. Worse, the net income numbers may be negative due to debt servicing.

Sales analysis should be a starting point in your research. Continue researching other aspects of the company. Read through the financial report and look for items such as operating income margins, debt analysis, and other important items. When you see sales increasing but net income decreasing, you may need to do some digging to discover the reasons why.

Just like erratic stock prices, though, if you feel that the revenue growth (or lack thereof) is all over the place, you are within your right to take a pass on investing in that company.