Understand the Drivers for Growth of Your Companies

When you understand the drivers for growth of your companies, you'll gain confidence when investing in them. You'll have the right mindset when companies release their financial information. This mindset is unconventional to most investors, and it is powerful for you as an investor.

Companies increase their revenues for a variety of reasons. Most investors simply look at the revenue increase and assume the company is performing well. However, plenty of companies have had strong revenues, but their stock prices don't reflect the growth.

To understand the drivers for growth, you have to know where to find the information that defines them. The answers to the following questions can lead you to this understanding.

- What Makes Your Company Successful?

- What Are the Risks?

- Why Will Your Company Exist Five Years From Now?

- Did the Company Really Grow or Simply Cut Costs? Or Sold Off Assets?

- What Is the Debt/Equity Structure of the Company?

- Can Your Company Explain Any Outliers?

What Makes Your Company Successful?

There must be great reasons why a company is successful. That seems obvious, but it's a point that's often overlooked. You can sum up Apple's success with the following sentence:

Apple offers quality products to a captive customer base.

The company has only to announce a new product and people are lining up at its stores. Apple has a cult-like following, with its customers being disciples. Their products aren't cheap, and they've been known to make prior versions obsolete quicker than anyone would like. Yet, their loyal fans remain unaffected and continue to buy.

Lately, though, Apple has been showing some growing pains. The company is trying to break into Asian markets. It cannot use the same cult marketing the company uses in Western markets. There are more obstacles for Asian markets (such as government regimes). Competition is another factor that is making sales more difficult for Apple.

[Source: Pham, Sherisse. “Apple Cuts IPhone Prices in China.” CNN, Cable News Network, 2 Apr. 2019, www.cnn.com/2019/04/02/tech/apple-iphone-vat-in-china/index.html.]

The point is that business situations are subject to change. It's up to great managers to navigate that change. Apple may figure out their Asian situation, but there are no guarantees. Pay attention to the language management uses when changes occur. Are they being upfront with investors or are they trying to gloss over their problems?

Read the Management Discussion & Analysis (MD&A) Section of the Financial Report

There's gold in them thar financial reports. It comes in the form of MD&A and footnotes. Specifically, management should be able to explain increases or decreases in sales. If it seems to be deferring to the footnotes a lot, or you notice in the financial statements that there are an inordinate number of footnotes, that is reason to be cautious.

Don't read only the current MD&A. Read through the previous years, too. You want to gain a sense for the track record of the companies you are considering (or already own). How well did the company meet the sales targets it set in the MD&A for previous years? What risks did they identify then, and how did they handle the risks?

Try to match up analysts' statements and reports generated during these previous years. Try to piece together a timeline of events and fill in any gaps with blog posts or forums. These can offer gems of information on a company that won't be delivered by the financial press.

What Are the Risks?

Your company may have identified what they feel are the risks in their business or industry. Put on your detective's hat and dig for information that may not be uncovered by the company or the analysts. Remember that analysts have incentives to beef up the companies for their clients. Take what they write with a grain of salt.

Read the MD&A reports of competitors of your companies. Do they identify the same risks factors? Try to find risks that are specific to your companies or to the industry itself. Consider as many risks as you can, including government regulations, social attitudes towards industries and companies, geopolitical factors, etc.

I mentioned reading through the footnotes of your companies. This is an important step. Too many investors bypass it which they miss opportunities to identify risks that companies may be trying to hide. Companies know that most investors won't read the footnotes.

Will Your Company Be Around Five Years from Now?

This is a subjective issue. However, if you determined that your company is a solid firm with good economics, and they haven't jacked around with their business model much (unless there was a justification to do so given in their MD&A), then you can reasonably expect the company to stick around.

Conversely, if a company's earnings are eratic (no visible trend), and the company seems to be waffling with no direction, it's going to struggle to be around in five years. It's still possible, but it will likely need serious capital infusions to keep it treading water. In any case, companies that follow this path are not ones you want in your portfolio.

Are Increased Earnings Due to Growth, or Cost Cutting? Or Selling Needed Assets?

For the most part, trimming costs isn't bad. However, if that is the only method used to increase a company's earnings, what's going to happen when there are no more cuts available? Think about your own cost-cutting efforts in the past. After you sliced your spending, you had nothing left to slice. There is only so much you can do. The same is true for companies.

You should commend companies that are lean, but their business models must be more than cost-cutting initiatives. No mission statement has ever contained the words "we are in business to cut the costs of our business." There may be businesses that helps other businesses cut costs, but that is not the same situation.

If increased sales or earnings are due to asset liquidation, that too, is not sustainable. A bigger problem with this situation is did they need those assets for future growth? If so, how are they going to make up for that growth now that the assets are gone?

There are legitimate reasons to sell off assets. They may be obsolete and outlived their usefulness. They may be broken. There are a host of reasons where it makes sense to sell assets of a company. However, unless the company is in the business of buying and selling assets short-term, this is not a growth driver.

What Is the Debt/Equity Structure of a Business?

The two principle ways a company pays for the assets that generate sales are through debt and equity. This is the foundation of the accounting equation. The equation is described as:

Assets = Liabilities + Equity

This is a rearrangement of the equation Assets - Liabilities = Equity. Essentially, it shows how assets are funded. If assets are funded by debt in a much larger proportion than equity, the company may be over-leveraged. This means that creditors may now have a claim on assets in the event that the company cannot meet its debt obligations. It also means the profits of companies may not be as strong as they seem.

Many investors like to quote the Return on Equity (ROE) as a measure for a solid company, the higher the number, the better. However, this measure can be deceptive. When the debt is high it will inflate the measure, giving investors a false sense of a company's strength. The takeaway is to peel back the layers that make up this ROE calculation to ensure the growth is solid.

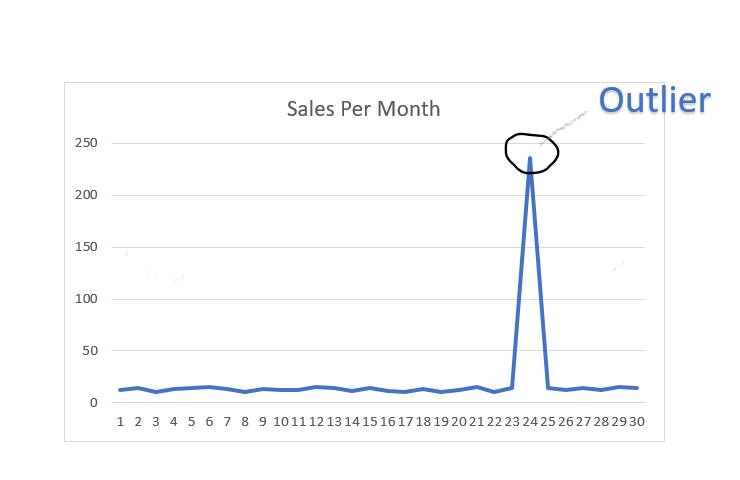

Are There Outliers in the Data for Your Company?

Did sales increase by an exhorbitant amount? Does the company offer a viable explanation for the increase? Are sales growing but earnings decreasing? What reasons does the company give for this divergence?

When something is out of whack, the company should have a logical explanation. If it doesn't, you'll be left wondering what the company is hiding. The financial press will come up with their reasons, but it may or may not reveal the true causes.

If you are an investor of a company, you can contact the investor relations department to inquire about these outliers.

Conclusion

The above items scratche the surface of getting to the heart of the drivers for growth. However, these are a great start and alone can reveal much about a company's health. Don't accept what the financial media spews out or analysts for that matter. Try to get the story from the company and back it up with data and information from blogs and forums. Take everything with a grain of salt but piece the puzzle together. The answers are waiting for those who go through this detective work.