Why Finding Competitors Is Tough

When analyzing companies, you'll often find you need to analyze the competitors of the companies your are considering. It makes sense, as the industry is a factor in your analysis. But when you start your search, you learn why finding competitors is tough. We'll explore some of the issues in this article, as well as some workarounds.

You can't analyze companies in a vacuum. That is, you may find a great company, but without comparing it against its peers or competitors, you won't get the full story. Competitors play a crucial role for your analysis.

Knowing this, you set out to search for competitors, only to hit roadblocks along the way. It seems like it should be an easy task, but it's not. The following discusses many of the challenges associated with finding competitors (followed by explanations of each):

- Competitors Are Not Clearly Defined

- Companies Compete in Multiple Segments

- The Size of the Company Matters

- Data About Competition Is Not Always Accurate

- Competitor Data Changes Often

- Tools to Find Competitors Are Expensive

- Competitor Info Is Not Primary Data Offered

- Competitors May Be Acquired by Target Company

Challenges in Finding Target Company Competitors

Competitors Are Not Clearly Defined

Did you know that Microsoft bought Nokia? It turned out to be a terrible move for the company. At least for a few years, Microsoft was in the smartphone business.

Many of us know Microsoft as the maker of operating systems. It is also known for its suite of office products. Therefore, they could technically compete with Apple and Google. Apple sells OS X operating system in its devices and computers, and other operating systems, too. Google has a suite of office products on Google Drive.

When Microsoft owned Nokia, they competed with Samsung and Apple (in a different segment). Today, Microsoft is heavily involved with cloud solutions with its Azure line of service offerings. Therefore, it competes with Google, Amazon, and Cisco, to name a few.

Microsoft also has several development tools that it supports. This means it competes with Oracle as Oracle bought Sun Microsystems several years ago. Microsoft already competed with Oracle on the database segment - just staying!

Microsoft also has a software suite of products called Power BI, which competes with the likes of Tableau and RapidMiner. Google also has a tool called DataStudio, so add them back into the competitor list.

As you can see from these examples, trying to wrap your head around which companies are competitors is challenging to say the least. Many companies blur the lines with cooperation and competition. This is shown with the relationship between Microsoft and Cisco.

Companies Compete in Multiple Segments

I've already touched on this to some degree in the previous section. However, many segments of a business may be related. For instance, Microsoft supports its Azure cloud access. Users could easily add development tools (Visual Studio) as part their subscription. How about some machine learning and artificial intelligence on the cloud? That is available, too.

The Size of the Company Matters

You can find two companies that fall into the same industry or sector (a level above industry). However, it's hard to imagine comparing Microsoft with a small mom-and-pop computer software company in Small Town, USA. Perhaps the small company competes with a tiny segment of Microsoft, but the it's doubtful Microsoft will even notice. The small company carves out a niche in its local area.

A company like Microsoft usually reports finances using consolidated statements, which means that all the segments, departments, and companies that fall under the Microsoft umbrella are reported together on financial statements. Comparing revenues of the small company is practically meaningless when measured against the giant.

Microsoft often does break out its revenues by segment on a separate section of its financial statements. But it won't necessarily break down the categories in a way that will be useful to compare smaller companies.

Data About Competition Is Not Always Accurate

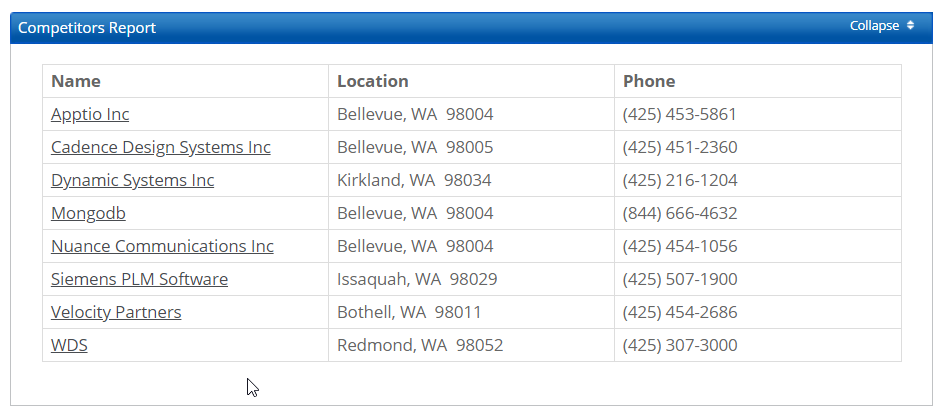

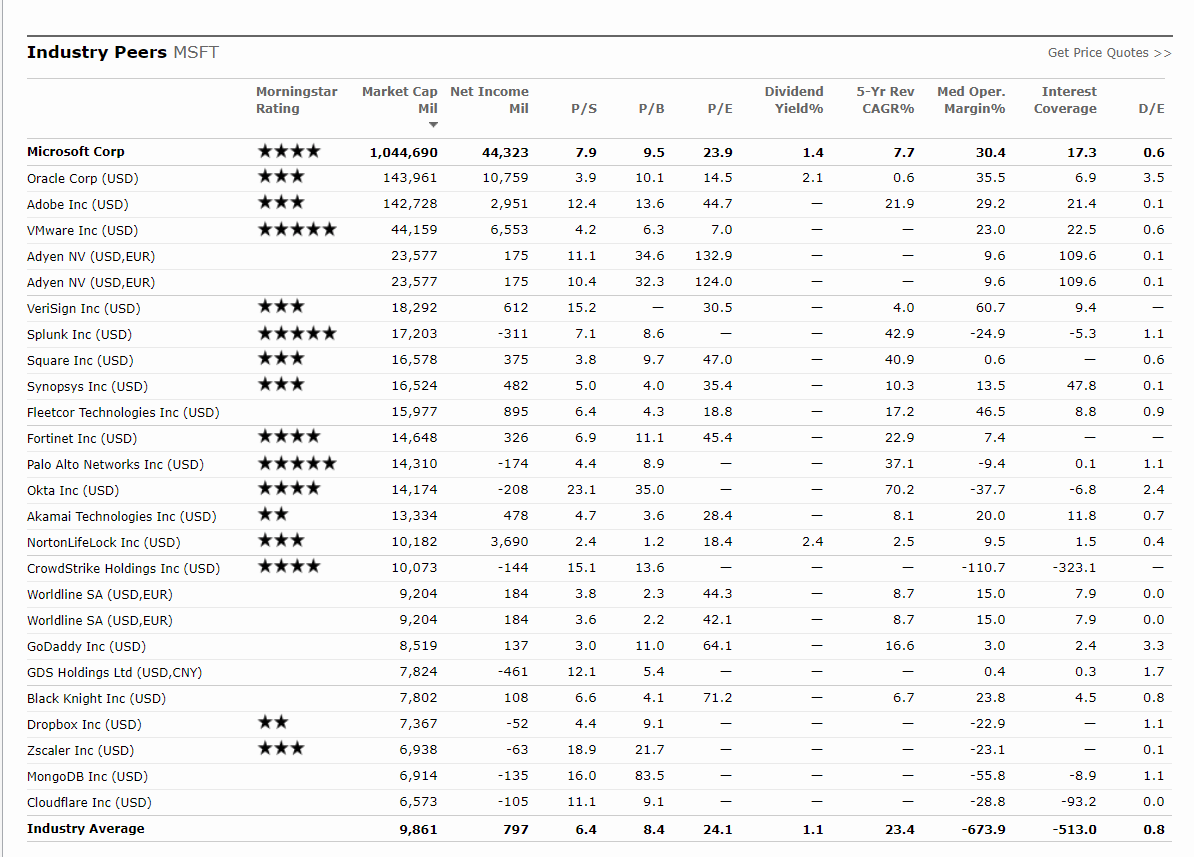

Take a look at the following image:

Now, perhaps you are getting a bit excited to know that you can find competitor information. Many local libraries make ReferenceUSA available as part of their offerings. You just need your library card number to access.

While I agree that Siemens PLM Software may be a good candidate for a Micosoft competitor, others are not so clear cut. Apptio, for instance, is a cloud-based company, which you could argue competes with Microsoft.

However, their cloud application is niche-focused, catering to the financial trading crowd. I can't find anything that suggests that Microsoft offers a competing product.

You may argue that Apptio uses machine learning as part of their product. That itself, may place it in a competing category with Microsoft. But machine learning is quite extensive. Most companies lay claim to incorporating machine learning. Does that mean most companies will now compete with Microsoft?

Competitor Data Changes Often

At one time, Morningstar.com and Yahoo Finance listed competitors for the target company you were analyzing. Those features seem to be gone from both now.

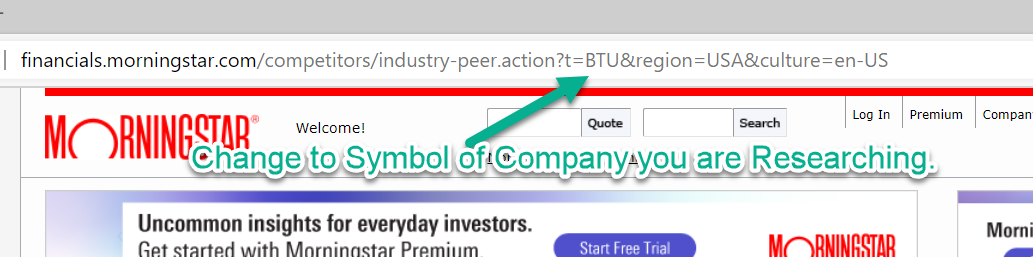

I am going to let you in on a little secret. There is a backdoor access to the old Morningstar interace for obtaining competitor information (at least at the time of this writing). It's not clear if the website will list it forever, though. I wouldn't depend on it, if I were you.

Here is a list of competitors Morningstar returned when I ran the query:

Seems like a goldmine of information, right? The trouble is, you'll have to know the industry well enough to know if each of these companies belong in the list of competitors for Microsoft.

I won't go through each of the items and compare how they would or would not be competitors of Microsoft. You would need to have a good handle on what each company does and where it could fit as a competitor. Now you can recognize why they pay financial analysts the big bucks. They need to know this stuff!

The takeaway for this section is you can't rely on free services to provide competitor data forever.

NOTE: If the Morningstar link is still working when you read this (my guess it is going away soon), then you'll need to change the stock symbol to that of the company you are getting competitor information. The example listed here shows BTU. If you were analyzing Microsoft, you would change the BTU to MSFT. It's the paramenter that comes after t= in the URL string.

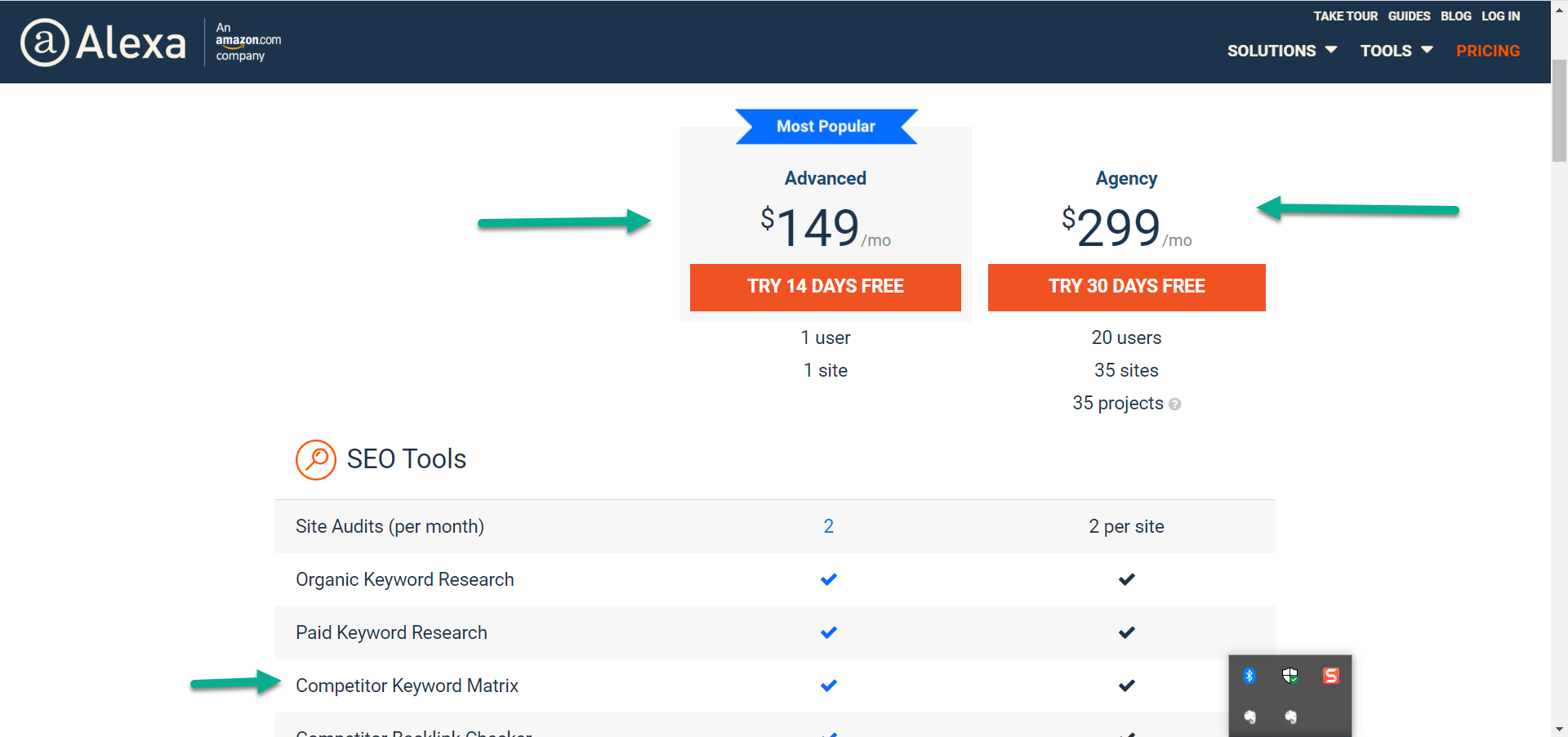

Tools to Find Competitors Are Expensive

Do you have a few hundred (or more ) dollars that you can spare every month? If so, you can get competitor data. You can subscribe to services like D&B. Alexa, and several others.

The following shows the pricing options for Alexa:

The good news is that many of these services will give you a free trial. I am not saying it is never worth it to have subscriptions. It's just that you'll need to justify the costs. If you aren't going to be analyzing many companies, try to stick with free services, if possible.

Competitor Info Is Not Primary Data Offered

Another problem with services that offer competitor information is that it is an ancillary function of the service. When Yahoo Finance included competitor information, it was one function among many. This isn't necessarily bad, but it may be an indication that the developers aren't putting all their effort in the one function.

Conversely, when you find a service that is specific to one function, like competitors, for instance, they will concentrate on that function.

Competitors May Be Acquired by Target Company

Suppose instead of Microsoft acquiring Nokia, Apple bought the company. At that moment in time, Apple would no longer be a competitor of Nokia. Therefore, any list that mentioned Apple, would likely remove Nokia as a competitor.

Acquisitions happen often in the corporate world. Sometimes, they happen for the sole purposes of having one less competitor to contend with. Companies buy other companies for a variety of reasons, sometimes just to remove them as competitors.

How to Overcome the Challenges in Finding Competitors

- Use Common Sense

- Pay for Premium Services (HBR, others)

- Use Better Searching Techniques

- Analyze Target Company's Financial Statements

- Read Analyst Reports Who Cover Target Company

- View the Resumes of Top Brass of Company

- Target Company Press Releases

- View Trade Journals

- Check Out Your Stock Broker's Research Reports

- Company Lawsuits from Competitors

- Product Comparisons & Reviews

- Look for Groups/Pages on Facebook and LinkedIn

- A Few Secret Sources - Shhh! Don't Tell! 🙂

Use Common Sense

You probably already know that Dunkin Donuts competes with Starbucks. If fact, any company that sells coffee as its staple item will likely be considered a competitor. Start with your common sense about a lot of companies.

For instance, you probably also know that Office Depot and Staples are competitors. Find products that both companies sell and search for them at other retailers. Try Target, Amazon, Walmart, etc. If you find these larger companies selling the same items, add them to your list of competitors.

Using a standard Google search won't often produce the results you want regarding competition. But it can't hurt to begin your search with Google to see what it does produce. I'll discuss later how to improve your Google searches regarding competition. However, start with the following keyword search:

Microsoft competition

Of course, you would change the company name to whichever company you want to know more about. You'll find a fair amount of information about competitors, although it will be piecemeal.

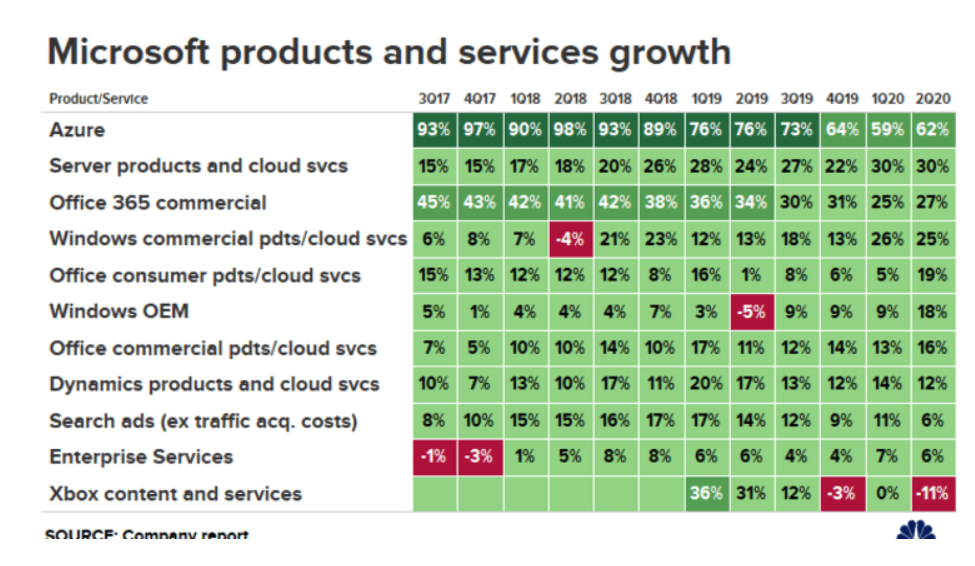

When scanning through the results of your search, if you find a website like CNBC or Bloomberg writing about earnings for your company, feel free to read the articles. For example, the following chart came from a January 2020 article from CNBC about Microsoft's quarterly earnings.

You could use the above information to learn which other companies compete in those segments. For instance, Azure is a cloud-based SaaS. Find out what other vendors offer these kinds of services (hint: Amazon is one!)

The articles you find with a standard search may discuss competitors of your target company. It's not a surefire way of finding this information, but every little tidbit helps.

Pay for Premium Services

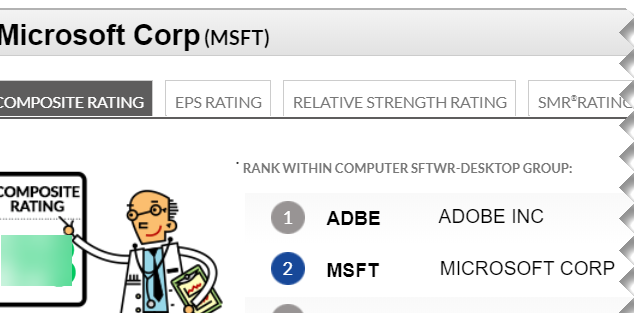

I hate to say it, but the best resources are those that cost money. I mention this not to encourage you to purchase subscriptions, but just as a frame of reference.

At the time of this writing, I have a digital subscription to Investor's Business Daily. The company offers different deals over time. I got in with a $5 for three week special. The Stock Checkup section provides some degree of competitor information. As usual, you'll need to decide if the level or degree of competition for each is acceptable.

Should you decide to pay for services, the premiums are usually rather hefty. You can expect to pay several hundreds of dollars per month for these services. Examples of services that may provide useful services are D&B, Thomson Reuters, and Bloomberg.

Yahoo Finance and Morningstar also offer premium services (among other providers). However, I haven't found whether these providers offer competitor information. I showed earlier how Morningstar still has a page that shows competitors, but it is an older page and who knows how long they will maintain it.

The following is a partial data dictionary for Zacks Company Profiles service:

While the company does not offer a specific competitor break out, using the industry code and sector information may help you obtain this information. This particular database costs $900 per year. That may seem like a lot of money until you break it out monthly, which comes out to $75. Unfortunately, it looks like you would need to pay the $900 in full.

Be sure to read the article to the end as I promised a few secret sources to find competitors!

Use Better Searching Techniques

Did you know Google has advanced search capabilities? While coverage of all the advanced features could fill up an article on its own, I'll specify some of the useful options for finding competitors.

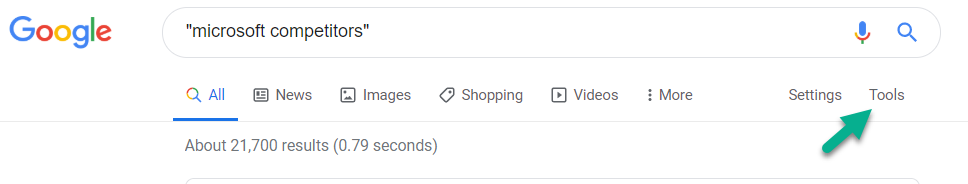

Search using Quotes ("") - when you want to search for a specific phrase, you can use quotes around your search. If you search for Microsoft competitors without quotes, you may get information about Microsoft that is both related and unrelated to competitors. Also, you'll likely get information about competitors in general.

Conversely, when you use quotes around the phrase "Microsoft competitors", your search will be more targeted to the entire phrase. It's not perfect, but it is better than not using quotes.

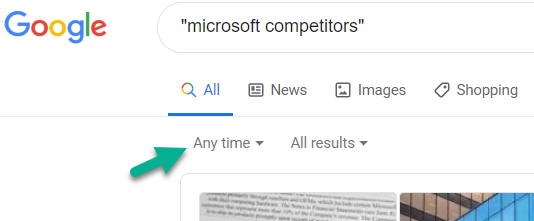

Ensure the Most Recent Information with Dates - It's unclear why Google doesn't always return the most current results first, but you'll often find results from several years ago appearing on the first page. By filtering by date, you can ensure that the results are for the most recent periods.

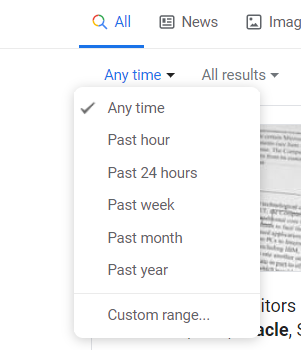

There are predefined date buckets that you can use. These include the past hour, past 24 hrs, past week, past month, and past year. The other options are for Google to decide (Any Time) or to define a custom range, where you can add any date range you think is relevant.

The following shows the sequence of steps to access this feature:

Step 1 - after initial query, select "Tools"

Step 2 - Choose date presets or custom range:

Step 3 - Choose the desired date selection:

When making your selection, realize that the closer you get to the current date, the less results are likely. This is even more the case for quoted searches.

The custom range is self-explanatory and won't be described here. Experiment with these options.

Use Google's site: operator - have you ever wanted to search a specific website for information as you feel it may have the information you are looking for? Google has a powerful site: operator.

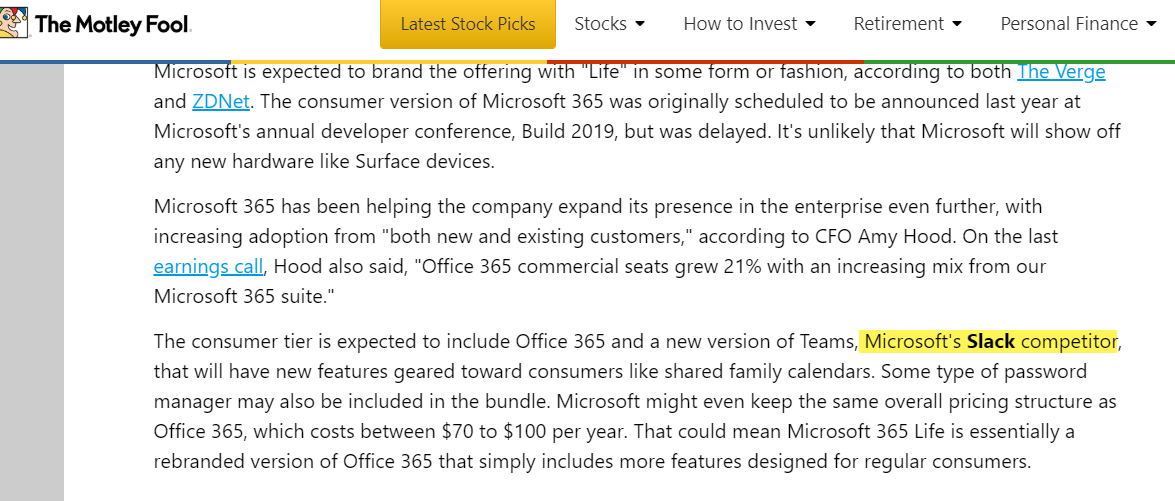

For instance, I used the site: operator for Fool.com (Motley Fool Investment Website) along with the search term Microsoft (no competition keyword added) and I found the following:

The command in Google is as follows:

site:fool.com microsoft

Reading through this article helped me realize that Slack is a competitor of Microsoft. Of course, this is something we would have known already when you look through the company's financial statements (next section: Analyze Target Company's Financial Statements)

Would I have received the same results with a standard Google search? Maybe. But who knows? The site: operator allows you to hone in on your search. You'll find this to be one of the more useful operators to use going forward.

Analyze Target Company's Financial Statements

Who better to know about a company's competitors than the company itself! This section describes where to find information on what Microsoft believes are its main competitors. The source of information comes directly from the financial statement reports. Here are the steps for locating and using those reports.

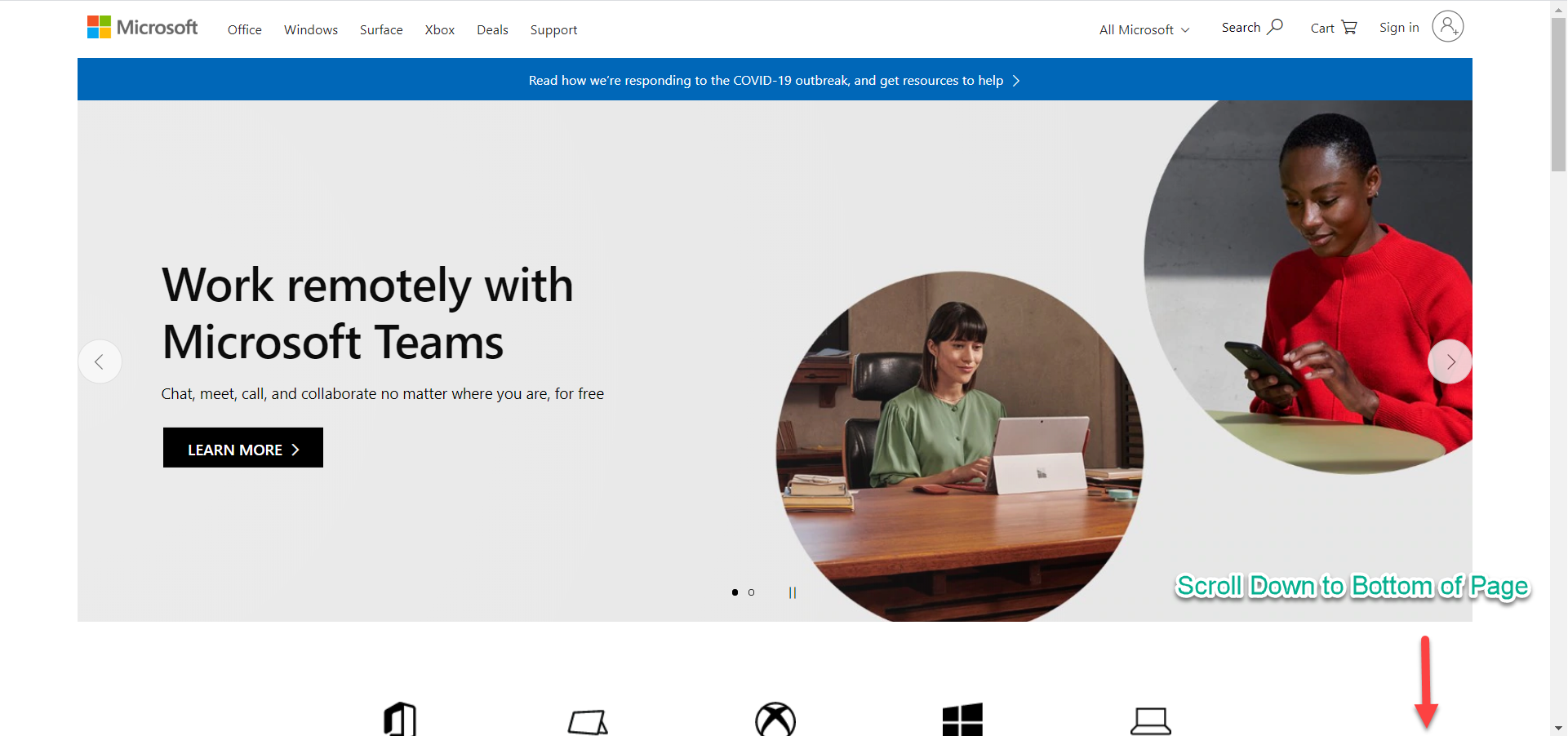

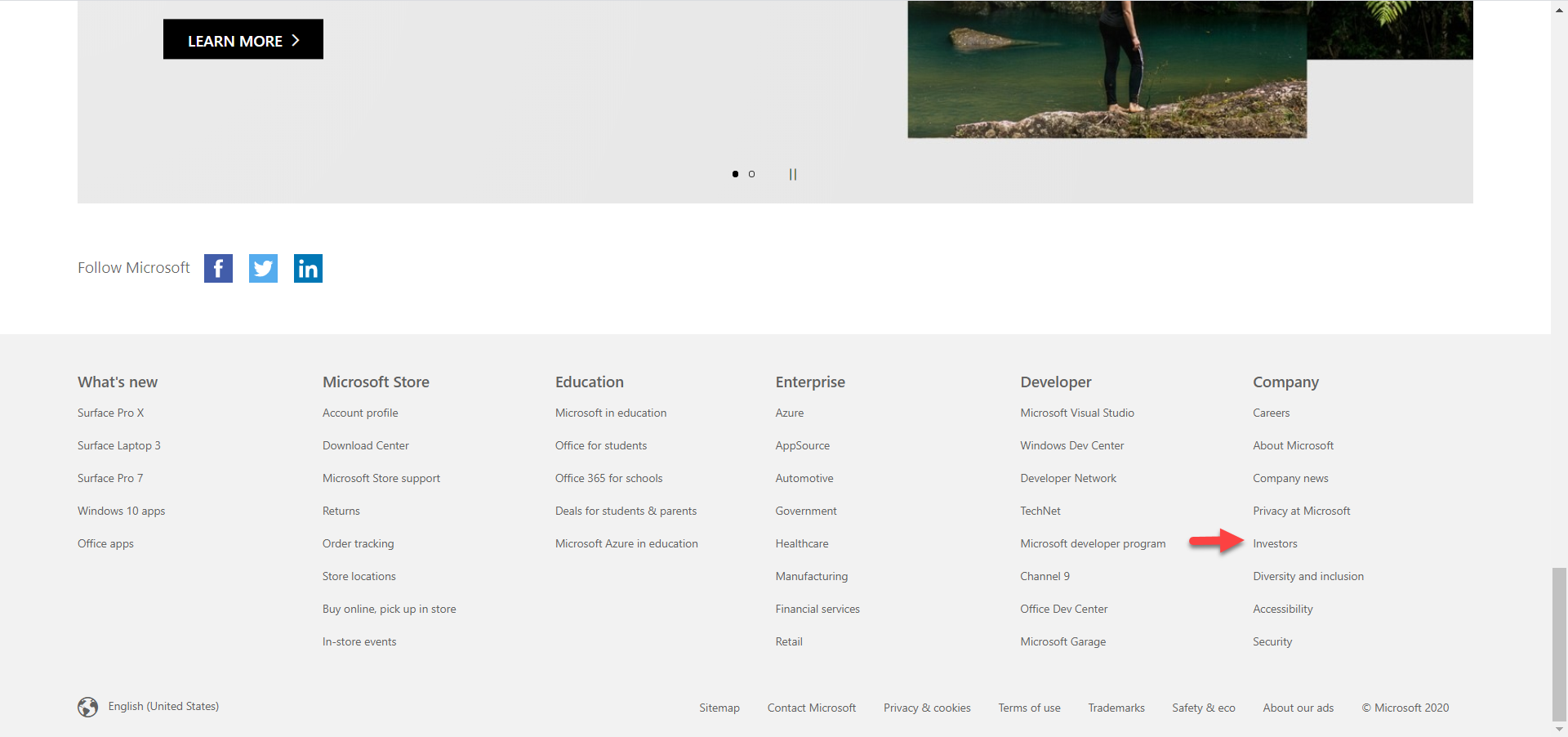

Step 1 - Go to Microsoft's website. Scroll to the bottom.

NOTE: It's possible to see a different view when you go to Microsoft. Companies change their websites often. This is true for all the screens going forward.

Step 2 - Locate the Investors menu option and click it.

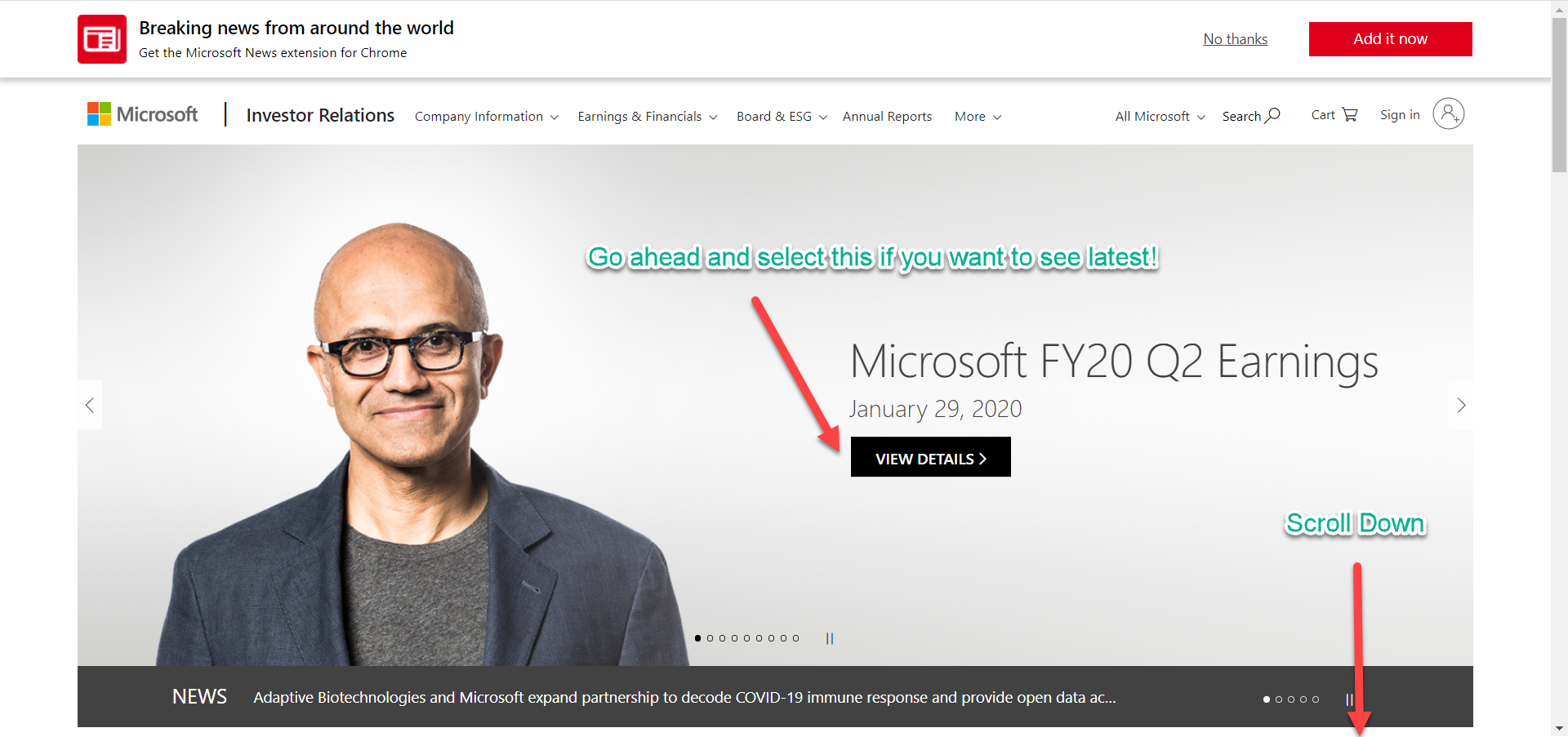

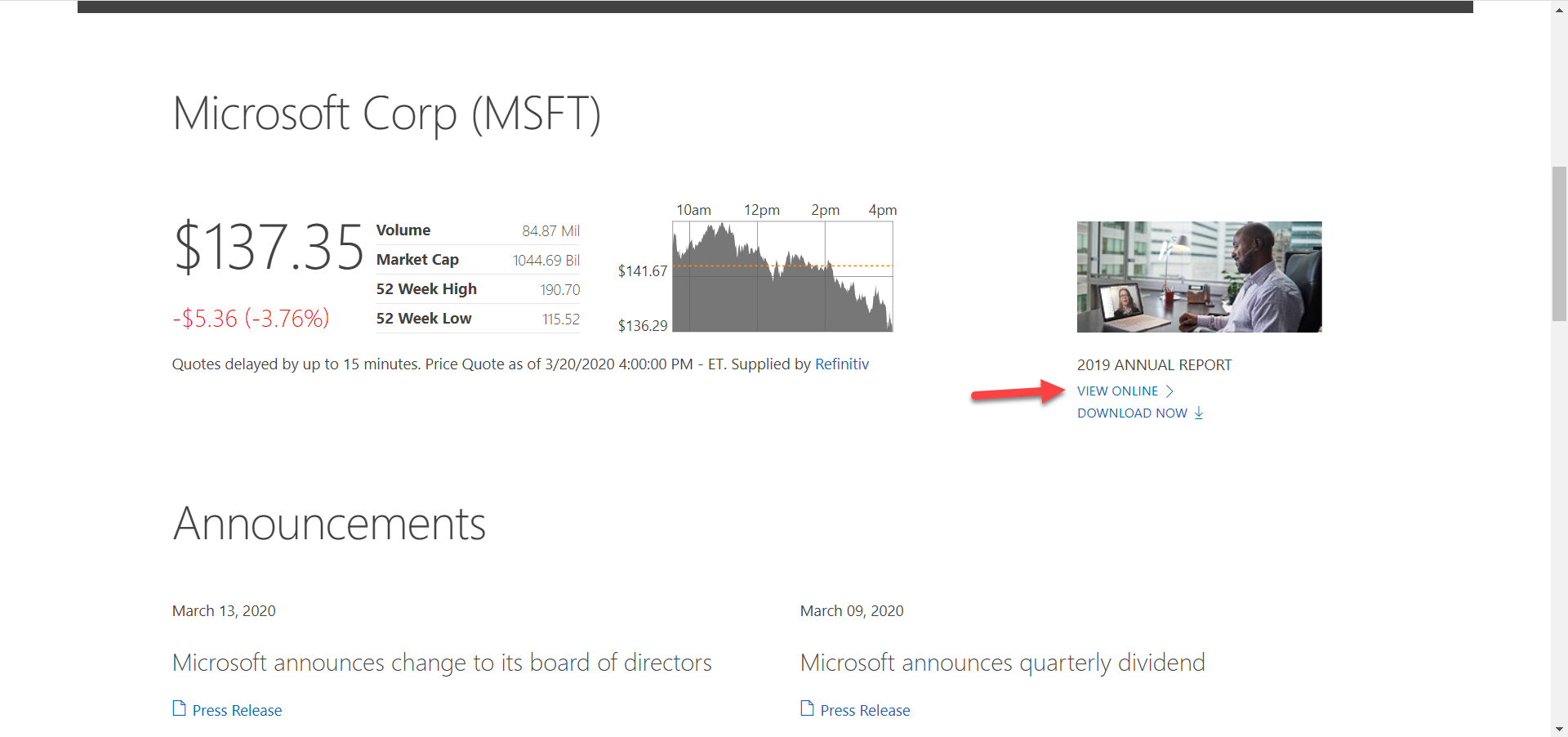

Step 3 - On the Investors page for Microsoft, scroll down until you reach the Annual Report section. Feel free to view the Quarterly Reports, too. That won't be covered in this article, though.

Step 4 - View or download the annual report. For this article, we'll view it online.

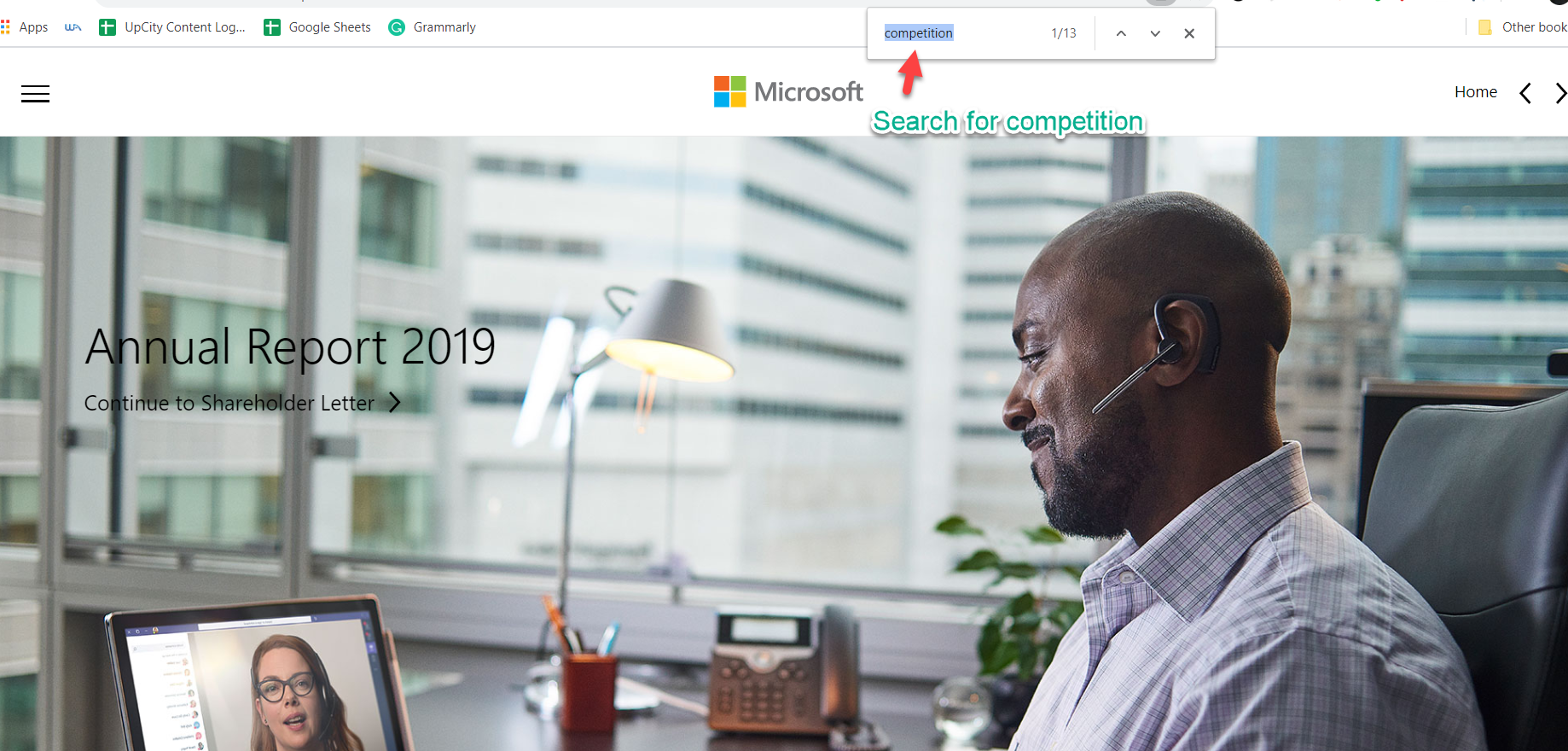

Step 5 - Search for competition - do this by using the <Ctrl> f or <Cmd> f (on Mac) and enter the word "competition" (without quotes).

Step 6 - Read through each section. For a big company like Microsoft, they will likely break out the competition by segment. That is what Microsoft did in its Annual Report.

You'll see the different companies listed that Microsoft considers its competitors within each identified business segment. I captured only three pages. There may be more. Scan through all sections that relate to competition.

As you can see, Microsoft has identified several companies in different segments. There are certainly ones that overlap, too. You should gain an appreciation into how complicated competitive analysis can be.

Microsoft competes in the Enterprise, Search, Office, and Gaming segments, among others.

NOTE: If you cover smaller companies, you probably won't have to deal with as many competitors.

As an aside, you could have used the SECs Edgar website to find Microsoft's financial statements. All public companies are required to file them with the SEC.

Once your gather a list of competitors, here's another little nifty trick: view the financial statements of those competitors. Find the competitors of their competitors. You'll still need to validate this new list to make sure they are active competitors of your target company. But you'll have more possible candidates to work with.

Read Analyst Reports Who Cover Target Company

Analysts do a great amount of research on the companies they cover. While some would argue about the accuracy of the reports they produce, it's likely they will get competition information correct.

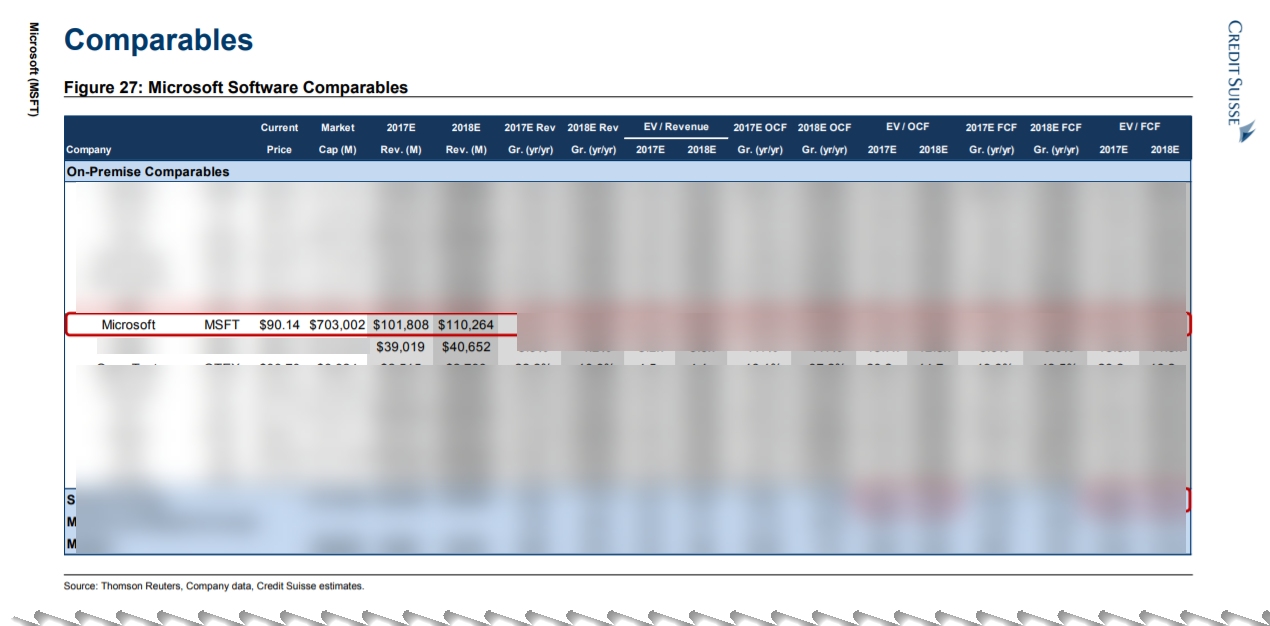

You'll have to do a bit of fishing to get the information you need. But I have a little trick that may help. When you append the operator filetype:pdf to a search, you'll open up a slew of options for your research. For instance:

microsoft stock analyst reports filetype:pdf

Using this search in Google (no quotes) I was able to retrieve a 2018 analyst report for Microsoft from Credit Suisse. One section of the report shows comparables for valuation. Score!

Caveat: Please be careful when using this option. For your own research purposes, there isn't anything wrong with using the information. However, you cannot publish this information without permission from the company or website where you downloaded it without permission. Companies take copyright infringement seriously. As you can see, I blurred out most of the report due to this!

View the Resumes of Top Brass of Target Company

Many times, CEOs and other top brass are recruited from other companies. Some companies prefer to promote from within, but that isn't always feasible. Some of these top brass will come from several companies within an industry.

Track these individuals on Wikipedia or LinkedIn. For our Microsoft examples, this method is not fruitful as the current CEO, Satya Nadella, was promoted from within. There isn't much about him in Wikipedia or LinkedIn. This just goes to show you that this method is hit or miss. It's still worth trying, though.

Target Company 8-K and Press Releases

When any public company experiences a major event that may affect investors' decision about the stock, the company must disclose this information in an 8-K filing with the SEC. The content of this document does not have to provide lengthy information about the event. The company just has to let people know.

Some people often confuses the 8-K filing with a press release. The two are not the same. Often, companies will submit a press release when they file an 8-K, but the two are separate items.

Either an 8-K or a press release can sometimes help investors discover competitors. It's not a surefire method, but it will pan out on occasion.

One resource that you should always use is Google News. Many of the press releases a company submits may appear in a search. While Google may not pick up smaller companies, a company like Microsoft is sure to "hit the wires."

View Trade Journals

Trade journals are interesting concept. They cater to a group of people usually in the same business segment or industry. While there are vertical businesses included, many of the subscribers are competitors.

However, they offer each other tips. In general, these tips are not sensitive trade secrets. But they can help the subscribers with methods or ideas to help run their businesses.

Most contributors of trade journals or associations will publish a byline about the company they run or own.

Therefore, if you have the ability to peruse trade journals within the industry of your target company, you'll learn about the competitors who contribute.

Trade journals are often a great way for investors to learn about the companies on their watchlists. Unfortunately, these trade journals are not free and often aren't cheap. However, for the purposes of getting a list of competitors, you can see if many offer free trials. It never hurts to ask.

If you have a few industries that you'll be investing in regularly, you may want to consider subscribing to a few of the trade journals. You can consider this a cost of doing business for your investing portfolio.

Check Out Your Stock Broker's Research Reports

Most brokers (both traditional and online) offer customers research reports. Often, these reports can be rather extensive. Some brokers will base the amount of research on the activity of customers. In other words, if you are an active trader, you may have access to more in depth reports than someone who makes a few trades a year.

What is included in these reports depends on the brokers. However, it's likely that many will include some form of competitor analysis. If you already have a broker, you can download a few reports to get a feel for what's included.

Company Lawsuits from Competitors

It's amazing how many companies will come out of the woodwork when a lawsuit is involved. Even if a competitor is not involved with the lawsuit, they're likely to make a statement about it. They'll take a side between two or more parties and they'll try to show how they would not do what the offending company did. They'll "take the high road," so to speak.

A class action lawsuit is even better. Competitors will stand together against the common enemy. Lawsuits are public knowledge and they would be difficult to escape the press for large companies like Microsoft.

One recent example is a lawsuit between Amazon and the US government. The US government awarded a contract multi billion dollar contract to Microsoft for cloud computing services. Amazon felt that it was the contender and should have been awarded the contract. The company is suing the federal government. For the purposes of competition, the results of the case is less important than showing that Amazon and Microsoft compete in cloud technologies.

Product Comparisons & Reviews

Reviews are great material for bloggers. They tend to rank well which is why you'll find plenty of them on the web. Some companies, like CNet.com, PCWorld.com and ConsumerReports.com report on products for multiple companies. This is like Competitor Knowledge 101.

Capterra is another website that provides comparisons and reviews. For instance, if you were looking to cover accounting companies, you could search for accounting products on the website.

When you view websites like CNet.com and PCWorld.com, you'll find they offer insight about the industries they cover. ConsumerReports.com does this too, but it is a premium service. They do offer some information for free, however.

Look for Groups/Pages on Facebook and LinkedIn

Groups and pages on sites like Facebook and LinkedIn are incredibly useful. When you join groups related to the companies on your watchlist, the people in those groups will engage in discussions. Sometimes, those discussions can involve competitors.

Some groups on Facebook are total junk, but many are legitimate. Groups that are private tend to be better at keeping the spam out. Some groups require being a member of a subscription, which means you'll need to pay. But usually, these groups won't be available for the public to see.

You can also join StockTwits.com. Like the name suggests, it's like Twitter for investors. You can gain a lot of insight and can even ask about competitors.

A Few Secret Sources - Shhh! Don't Tell!

There are two sites that I have discovered that can give you an idea of the competitors of your target companies. These are:

Comparably.com - I tried signing up for this website and the sign up process was a nightmare. It makes you wonder if their development team even used any QA techniques or tested out with a user group. The takeaway here is don't bother signing up. Just use the site as is. Of course, if you like frustrating and annoying processes, you'll love the sign up process. 🙂

Owler.com - the sign up process for Owler.com is not annoying and quite easy. You can sign up for free, too. When I signed in, I looked for Microsoft, and it came up with many of the same competitors as Microsoft's financial statements listed. I don't know if Owler sources its data from financial statements, but at least for Microsoft, the data seems accurate.

Knowledge of Competitors May Not Be Enough

If knowing who the competitors are, how can that not be enough? Why do we even go through this process? I already touched on this a bit, you have to know your industry to understand whether a competitor is a good one.

You could choose to use all the competitors you find (from the methods above). However, suppose for Microsoft, that Google, Oracle and IBM have P/E ratios of 25. But then you have a lesser-known company like Proofpoint has a P/E ratio of 15. If you are trying to run a comparables analysis, the Proofpoint P/E can skew the results.

Again, knowing your industries and what numbers make sense will go a long way in solving this problem.

Conclusion

I choose a complicated company like Microsoft to illustrate many of the issues analysts face when analyzing companies. Competitor analysis is more of an art than science. If you think you'll be able to automate the analysis of competitors, hopefully this article shows how difficult that task will likely be. It may be possible soon with artificial intelligence and other related tools. But we're not there yet.