What Is Your View on VOO?

Many investors are considering Exchange-Traded Funds over mutual funds. The expenses are typically lower, and they are more tradeable. It's like having the benefits of a mutual fund but with the ability to trade like stocks. When think of investing in the S&P 500 index using ETFs they often turn to the Spyder (SPY). But there is a lesser-known option offered by Vanguard. This article asks what is your view on VOO?

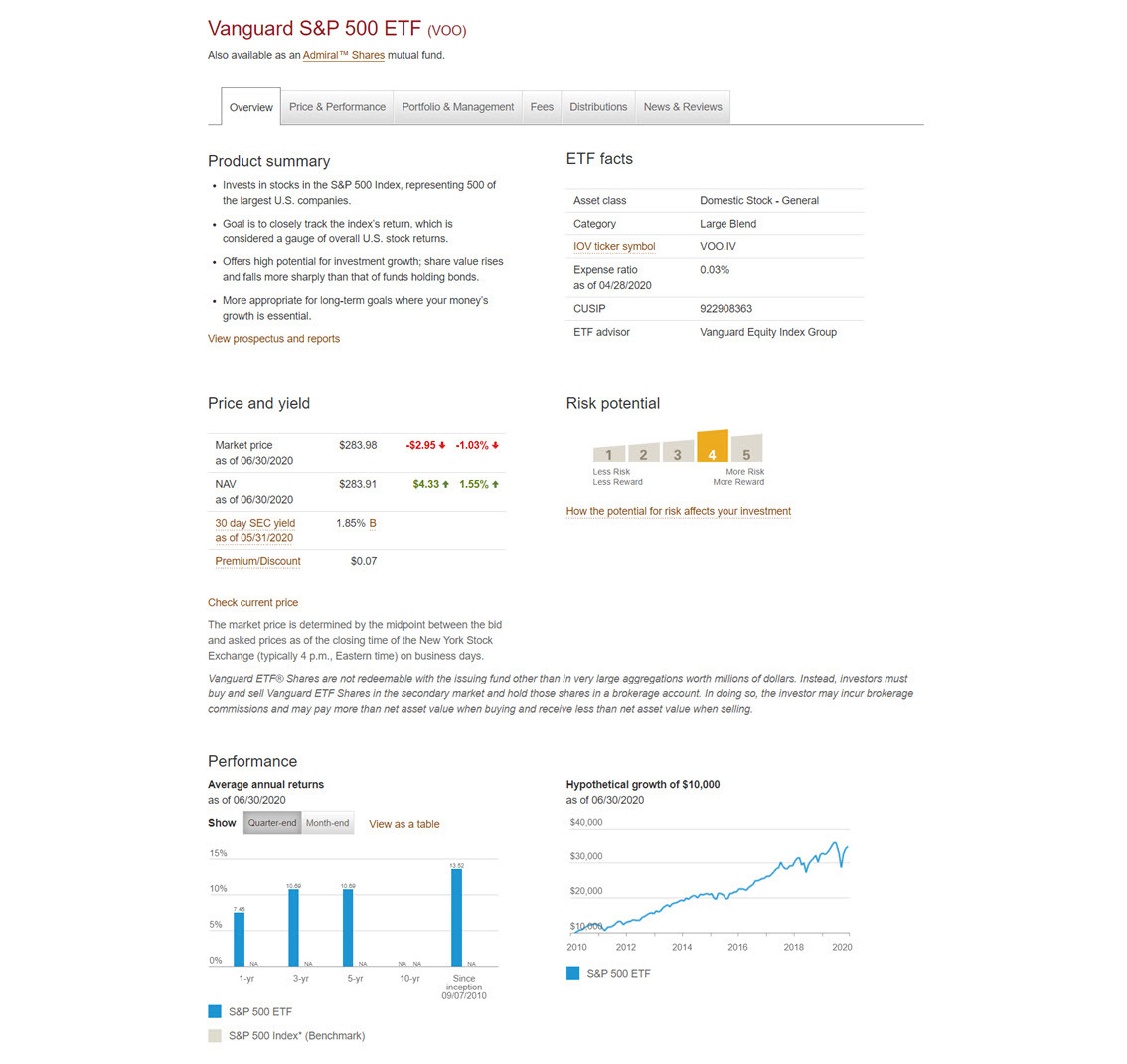

VOO is the ticker symbol for the S&P 500 ETF offered by Vanguard. I haven't found any information yet on why they used VOO as a symbol, but the obvious choice would be that the "V" is for Vanguard and the two "OO"s represent the two "00"s in the S&P 500.

However it was named, VOO is an alternative to SPY. So what's the difference?

The biggest difference is in the expense ratios. At the time of this writing, VOOs expense ratio was 0.3% while SPY was 0.9%. SPY is more popular, which could explain the difference in ratios.

Disclaimer: the information in this article is for informational purposes only. Please consult a qualified financial adviser for advice for your portfolio. This information should not be misconstrued as investment advice, implied or otherwise.

Related: A Few Ways to Invest a Lump Sum of Money

Will the Divergence in Expense Ratios Matter?

When you invest in index funds, you likely will hold them for the long term. They track the performance of the index that comprises them. An index is often used as a benchmark. The S&P 500 usually represents the health of the stock market. There are indexes for individual sectors, too.

If you can save money on expenses, then it seems to make sense to choose the option with the smaller expense ratio, which would be VOO. However, if you decided to choose the SPY to add to your portfolio, it's not likely to amount to much of a difference in the longer term. Therefore, if you already have SPY in your portfolio, it doesn't make much sense to switch. You could buy VOO shares going forward as you add to your portfolio, if you feel you want to participate in this savings.

Should You Choose an Index?

Many investors feel they can do better than the overall market, i.e., the S&P 500. Others suggest that people may get lucky, but in the long run, stocks revert to the mean of the benchmark. Whether indexing is right for investors depends on their outlook on beating benchmark returns. However, by choosing an index like the S&P 500, investors can be assured of at least matching the market.

Related: Start Investing Even When You Don't Know How

Trying to beat the market often requires active trading. Over-trading in a regular account (non-retirement) will generate capital gains taxes. This eats into the returns.

Index investing is generally considered to be passive. You buy an ETF or mutual fund that tracks the index and you only generate capital gains when you sell.

Index Funds Are Boring

It's rare for people who like to brag about their investments to tout the benefits of index funds. They like to boast about their biggest winners. Of course, these same braggarts remain quiet on their losing stocks.

Related: Should Young People Take More Financial Risks?

Index funds (and ETFs) are boring. They aren't the subject of many office party conversation, if ever. But the returns are consistent. Use history as your guide. Time-after-time, the stock market as a whole has produced respectible gains, even in light of major events happening along the way.

The Big Bet on Active vs Passive

In 2008, Warren Buffett challenged hedge fund managers. He made a bet that passively-managed funds would outperform actively-managed funds handily. One hedge fund took Buffett up on his bet. The rules were the hedge fund manager would choose among five actively-managed hedge funds of his choosing. Buffett would invest in an S&P 500 index.

The bet was for a 10-year period. The hedge fund manager threw in the towel after the ninth year, because Buffett was so far ahead. The proceeds went to the winner's charity of choice.

Buffett had no doubt about the results of the bet - he knew he would win. He may not have won if he made the bet for two or three years, however. This shows that it is possible to beat the market in the short term. But the market catches up eventually.

Going Back In Time...

If you are an experienced investor, check out some of the stocks that you owned 15-20 years' ago. Do you still own them? Are some of the companies you bought out of business? If you sold your stocks, what would your returns be if you kept them to this day?

Remember that the market hit a decent rough spot in 2000 with the dot com meltdown. It had an even rougher go at it during 2008-2009 with the mortgage meltdown. The S&P certainly took a hit during these two meltdowns, but likely held up much better than individual stocks. Why?

An index is comprised of several assets which makes diversification a strength for that index. The S&P represents 500+ stocks. I use the plus sign because some companies include multiple classes of their stocks. Berkshire Hathaway (the holding company Warren Buffett manages) has both A class and B class stocks. For all intents and purposes, it's safe to say that the S&P index consists of 500 stocks.

Related: What Are the Risks of Investing in Stocks?

The weightings of holdings of those companies are not equal, however. Some companies like Apple and Microsoft, make up a larger weight than the other components. These weightings may change over time, too.

No matter how the index is composed, the key takeaway is that diversification offers some protection for investors. It's quite likely that compared to a portfolio of individual stocks, the S&P index will have outperformed it over that 15-20 year period. They'll be exceptions for some people, of course. But even here, their luck is likely to run out eventually.

What About Commissions?

I know some experienced investors are screaming at me while reading this saying that I didn't factor in commissions. The truth is, many brokers have done away with commissions for several classes of stocks. If you money in a major brokerage, it's possible that trading the VOO or the SPY will be commission-free. Do check with your broker to make sure. Of course, you'll know as soon as you make your trades. The commissions will calculate as part of the total.

It's possible that brokers could reintroduce these commissions at some future date. However, at the time of this writing, you may find that your trades are free of commissions.

Conclusion

Investors who feel indexing is right for their portfolios should consider all the options. Mutual funds are still a viable way to participate in index investing. However, the lower expense ratios of ETFs along with no-commission trades can give a boost to any portfolio.