You’ve Paid Off Your Mortgage. Now What?

You and your spouse celebrate the fact that you'll no longer have to shell out bucks every month for your mortgage payment. You've managed to pay it off early and good for you! That's a big chunk of your expenses each and every month that you no longer have to pay.

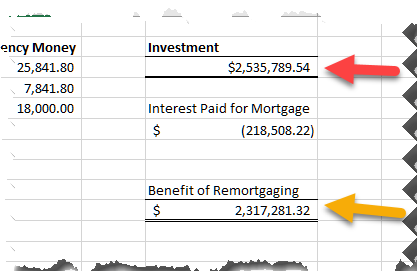

Suppose you learn that your house is worth $360,000 and someone convinces you to take out another mortgage on a portion of the house value? Then, he or she tells you to invest that portion into the stock market. After thirty years, based on the assumptions given throughout this article (and a corresponding spreadsheet), you would be about $2.3 million richer. That seems like a no brainer, right?

Whether it's a good idea will depend on the person faced with the choice. If you are a disciplined investor, it can indeed be a wise move. After all, with the average mortgage rates in the United States being at 4.70%, that is relatively easy to beat in the stock market. Market pundits will tell you that historical returns for the stock market are between 10% and 11%. But, even a more conservative estimate of 8% to 9% is still a respectable rate of return considering you are paying less than 5% on your money for the mortgage.

Are You a Disciplined Investor?

If you are a disciplined investor, then taking out a new mortgage for the purposes of investing the loan may be the way to go. However, the average person is not disciplined. They will end up taking out the mortgage and spending the proceeds. Once it's spent, it's gone. Then, they are left in the same financial position as they were before paying off the mortgage. And, they are stuck with this for the next 30 years, depending on the terms of the loan.

Why Do Financial Advisors Recommend a New Mortgage for Homes?

I am not trying to bash financial advisors here. From a purely conceptual perspective, the advice is sound. You can't beat the rate you get on a mortgage, nowhere, no how! However, financial advisors make money from helping you invest your money. And you need money to invest for them to collect their fees. It's in their best interest to convince you that taking out a new mortgage for investing is a wise move.

What They Don't Tell You

Great. So, you are going to make boatloads of money and after thirty years, you'll have paid off your mortgage and gained the difference between the returns in the market and the interest on the mortgage. In financial circles, this is known as the spread and it's how banks make their money. However, what these financial gurus don't tell you is that there are pitfalls with this approach. Here is a summary of those pitfalls:

Let's go over each point in detail.

A Mortgage Payment Is a Big Chunk of Change

You know already how large a mortgage payment is on a monthly basis. After all, you have been paying one for quite some time. To get a feel for how much a new mortgage will be you'll need to find out the value of your home. You can do this by searching for listings of homes selling in your area that have similar features to your home. This is called comps or comparables in the real estate world. Comps are usually on homes already sold, but you can still get a ballpark estimate of how much your home may sell for with current listings. You could also ask a real estate agent for comps, just be respectful of his or her time when doing this. If you go this route, consider throwing a few referrals to the agent now and again. As a last resort, you can use the amount that is assessed on your property taxes statement.

You can download the spreadsheet that I used for my analysis and change the numbers per your situation.

Suppose you determine your house is worth approximately $360,000. The bank would send an appraiser to determine what it feels the house is worth. The bank is not likely to mortgage the full $360,000 except in extreme circumstances. They want you to maintain a certain amount of equity in your home which helps reduce your chance of foreclosing. Seasoned homeowners are not known to give up their equity without doing all they can to keep the home.Hence, they are less likely to foreclose than newer homeowners.

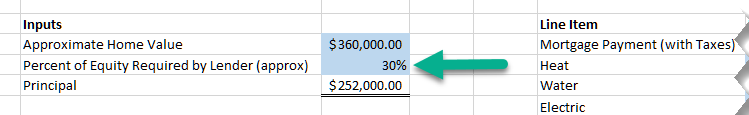

Suppose a lender is willing to mortgage 70%. This lender feels confident with you keeping 30% equity. After all, they usually require 20% down for new homes and you have a track record in paying your mortgage off. For 70%, that would be a mortgage of $252,000 ($360,000 x .70).

Note: if you are working with the included spreadsheet (see below), the cell pointed to with the green arrow indicates how much equity the bank wants you to maintain. When you enter a number, the principal will be calculated using the inverse (1-percent of equity required by lender). For our example, you would enter in the 30% which represents how much equity you would have in home after getting the new loan, but the bank will lend you (1-.30 = .70). The 70% represents how much equity the bank takes away from you in exchange for the cash. When they give you $252,000 which is 70% of the $360,000, the remaining portion will be how much you own (30%).

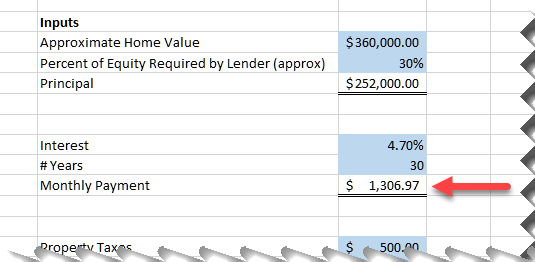

Let's assume you took a 30-year mortgage on that $252,000. That leaves you with a monthly payment of $1,306.97.

Each state (and even counties/towns) will have a different property tax rate. Let's assume that yours puts you on the hook for $6,000 per year. For some people this may be grossly underestimating the amount. For others, it may be a bit high. You can adjust it in the spreadsheet.

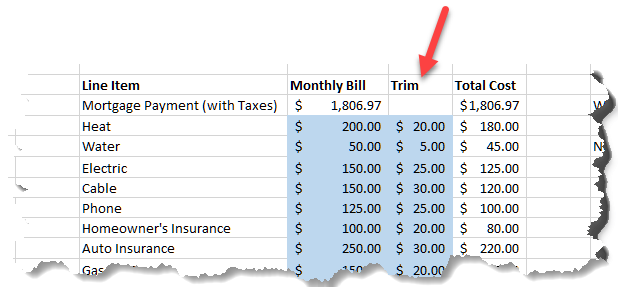

To continue, $6,000 in taxes is $500 per month. The total for your mortgage and taxes is $1,806.97 ($1,306.97 + 500):

As an aside, if you paid down your mortgage in its entirety, you'd still have the tax payment. That sticks with you until you sell the home.

The Impact of the New Tax Laws

You may see more in your paycheck as a result of the new tax laws but the deductions for houses is not so clear cut. Prior to these tax changes, many people enjoyed the benefit of these deductions and real estate agents often used them as selling points. Of course, the Alternative Minimum Tax (AMT) may have played a role in wiping out those gains for some homeowners. For the purposes of taking out a new mortgage, know the effects of these changes.

Healthcare Costs

Whatever side of the argument you are on regarding the Affordable Care Act (Obamacare), you must factor this in when considering your costs. There are too many factors to cover in any detail without the topic becoming overwhelming. This isn't about whether Obamacare is right or wrong. It may be something that affects your finances and should be considered when taking out a new mortgage.

Your healthcare costs may be covered at work and maybe you are one of the lucky few whose company still covers spouses and family members. Many companies are only covering employees and could strip away coverage for your family. Your company may cover your family but require you to pay the full costs and deductibles. Those costs are not what most would consider cheap.

The point is you'll need to learn what the potential costs of your healthcare based on various scenarios. If you get laid off, are you covered? If you start a business, what kind of coverage will you find, etc.?

Financial advisers and planners often suggest setting aside three to six months worth of expenses for emergency purposes. I believe with healthcare you should extend that to at least one year and even that may not be enough.

Conversely, if you decide against taking out a new mortgage, you have at least most of the payment you'll need to cover health premiums and costs if you are faced with having to pay.

Other Debts to Weigh Down Your Finances

Do you have a car payment? How about credit card payments? If you are an average American, you have both, and maybe even a few student loans thrown into the mix. These are payments that will add to your monthly obligations. You should consider getting rid of these before taking on a new mortgage. The rate of return that you receive from your investing will be offset completely by these costs.

You could use a portion of the new mortgage to pay down these costs. However, you will no longer have that portion to invest. A better approach is to use what you would have paid for your mortgage payment to pay down that debt. Then, if you decide to take out a mortgage at that point, you won't have that extra debt dragging down your returns.

You should also consider that the bank will require an escrow payment to be held for collection and payment of property taxes. As you already know from paying your previous mortgage, property taxes are seldom static. Therefore, it's reasonable to assume that your escrow will increase whenever your taxes rise. It's rare for taxes to fall. At best, they stay the same for a given year, but that's not likely.

Banks usually give you the choice to pay the difference as a one time payment or to roll it into your existing payment. This cost is not considered in the overall calculations on the spreadsheet. You can choose to add it as a line item on the expenses section (Other 1-6).

You Are Not a Disciplined Investor

Most people don't understand investing. These people should stick to investing in an S&P 500 index fund. When people start making decent money from their jobs, they tend to take higher risks with their investments. They get caught up in the frenzy of the Wall Street high rollers and believe they can achieve the same or better results. Most are disillusioned and lose money.

If your are a disciplined investor, then you may be a ripe candidate for taking out another mortgage. Of course, make sure you have no other debts and your prospects for employment are strong and will remain strong for the next 30 years (duration of the new loan).

What If You Lose Your Job?

Perhaps you feel confident with your job prospects for the next 30 years. That's great. However, things change. You get older and your salary increases. As this continues, you get to a point where companies feel you carry too hefty a premium and they look for someone younger (and cheaper).They decide to let you go. These days, people are being let go without much to show for it. Severance packages are not a given and often come with strings attached, like non-compete clauses.

Whatever your age you are when you are let go, there is no guarantee that you'll find another job quickly. The hiring process itself can take several months for medium to large companies. For some reason, companies believe that you need to meet every manager up the chain before they make a decision whether to hire you or not. Good luck getting all the ducks to line up in a row!

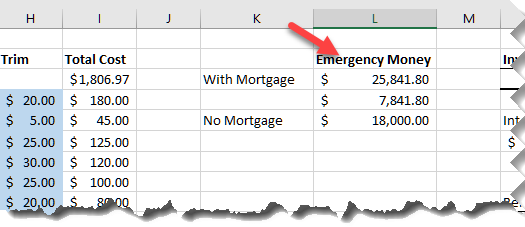

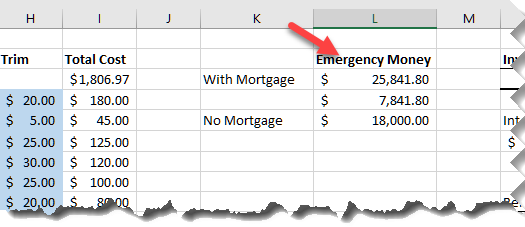

When you are laid off, you'll need to rely on your emergency cash for living expenses. This is where having a mortgage hurts. It's your largest outlay. With our current spreadsheet scenario, six months of living expenses would come out to over $25,000.Without the mortgage, it would be over $18,000. That still hurts, but it's way better than the $25,000.

You can adjust your amounts for any unemployment benefits you may receive. It will bring down some of the costs for the duration. But, unemployment only lasts for a short period. Many states are cracking down on extensions, too.

Investing the Payment You Would Be Paying to a Mortgage

Paying off a mortgage means no longer having to pay that monthly principal and interest. Instead of taking out a new mortgage, why not use the payments you are no longer paying to the mortgage company into an S&P 500 Index Fund? In other words, why do you need a new mortgage when you can simply invest that payment monthly for the next 30 years or so? This is a less riskier approach as if you do get into financial trouble, you're not on the hook for a mortgage.

I didn't include a calculation for this on the spreadsheet because I don't know what your mortgage payment is for your original mortgage (that you are no longer paying). If you want to see what the impact of this is, simply take the future value calculation (FV) and use the same 8% return assumption for 30 years. Suppose that mortgage payment is $1,100 per month. You could use the formula as follows:

=FV(.08/12,30*12,-1100)

Since you would be investing on a monthly basis, you need to divide the rate of return by 12 and multiply the number of periods by 12. Also, I used the negative sign for the payment since you are paying out that money.

When you enter the formula into the spreadsheet, it will show a result of over $1.6 million. I don't know about you, but that is a respectable amount in my book. This is without the risk of carrying another mortgage.

You could apply the formula with the new projected mortgage payment (from the spreadsheet), but the value of your home is likely to be more than original value when you first purchased your home. In other words, the monthly payment will be larger than the payments you were making on your old mortgage and it isn't practical that you'd set aside more money each month.

A financial adviser would likely counter these arguments with the fact that you won't make as much with this method, and this is correct. First, since the old mortgage payments will be less than the new payments, you'll have less money working for you. Second, a new mortgage gives you a large sum of money upfront to invest. However, while your returns won't be as large, your assets under management are less which means less risk. Sure, the adviser will throw terms at you such as opportunity costs and other high-falutin finance words. But, this option helps you sleep better at night.

Determine Your Monthly Expenses

If you decide to move forward with mortgaging your home after it's been paid off, you must determine what your monthly expenses are. Then, you should project different scenarios based on the numbers.

Download the spreadsheet here.

To continue with the scenario from our spreadsheet, a $360,000 home value and a 30% equity requirement, would give you a loan of $252,000. This is a nice sum of money to invest in the market and would net you a return of over $2.3 million after thirty years (future value with 8% for 30 years minus the interest paid on the mortgage for that same period). This, of course, assumes that you didn't need to draw on that sum for any reason within that 30-year period.

The Spreadsheet Explained

I am including the spreadsheet I used for my analysis. You can download it and adjust the numbers to fit your situation. You'll find that some of the numbers are higher than you'll pay, while others are lower. There are too many variables to capture every scenario.

I tried to set up the spreadsheet to be as intuitive as possible but felt I should give explanations on how to make changes and interpret the numbers.

The sections in blue are your inputs. Change the numbers according to your situation. For instance, for your home's value, enter a number based on online listings of similar houses in your area or some other method as discussed previously. Then, estimate how much equity you think a lender will require when you to maintain. You could start with 20% as that is a standard requirement for new homeowners.

Next, adjust the terms of the loan both for the length and interest rate for the loan. You can ask real estate agents for approximate costs in your area. Potential lenders can give this to you. Or, you may simply find resources online that will give estimates.

The second section is where you can enter your monthly bills. I realize they may fluctuate from month-to-month, so you can either average the previous twelve months or make an educated guess.

What is the Trim column?

You can control some of your costs. For instance, suppose your average electricity bill for the past twelve months is $150.If you buy new appliances that are more energy efficient, you may be able to trim the costs a bit. The amount that you trim goes into the Trim column.

Notice this spreadsheet does not factor the costs of buying the new appliances for simplicity sake. You could amortize the costs and add them as one of the extra (Other) columns.

If you don't understand or like the Trim column, just zero out all the values and put in the costs in the Line Item column. For me, I like to see what the cost would be before and after I apply efforts to save. But, it isn't necessary for the analysis. It won't make that much of an impact.

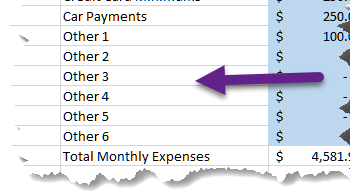

'Other' Line Items

I have set up several line items that you can use to add expenses that I didn't account for. You can rename them as you see fit. They are already part of the totals for the columns (default 0 value) so when you enter a value it will reflect the new value in the total columns. This is important as other calculations depend on those total columns. Hopefully, you won't need more line items than what is given. But, if you do, you'll have to adjust the total columns accordingly to reflect the new cells.

Emergency Cash

I touched on this previously mentioning how financial advisers suggest keeping about 3 to 6 months in savings for any emergencies that may arise. The worksheet is set up for 6 months, but you can change it to whatever you like in the first set of inputs. It is the column labeled:

# of Months for Emergency Savings

The section labeled Emergency Money will use all the inputs and derive the calculation based on what you enter for those inputs. This will give you an indication of how much money you'll need and the impact that a new mortgage will have.

Investment Column

If everything works out the way many financial planners suggest, the Investment column will show a significant future value for the term of the loan. This figure does not include any commissions or costs and assumes that the investment is held for the duration. The interest that you will pay on the mortgage is included and is subtracted to give you the Benefit of Remortgaging your home.

Other Assumptions

The spreadsheet included does not factor in tax deductions of interest, AMD, or capital gains when you sell the investment. You may also come across expenses that requires a significant outlay of cash. For instance, a new roof could cost $10,000 depending on the work that needs to be done, etc. But, these costs may happen whether you remortgaged your home or not and should be subtracted from the total that you get for the house when you sell it.

Final Analysis

There's no denying that should everything work as planned, investing a new mortgage on your home after paying it off can be lucrative. In many ways, though, it is the perfect storm. Too much can go wrong and often does. People often start out with great intentions, but when they face financial difficulties, they tap into this source of income.

That can be a big mistake. For instance, suppose you decide to invest the money from your new mortgage and after a few years the portfolio is not performing due to a market correction? If you pull the money out and use it, that money is gone for good. You still have the obligation of paying back the loan even if the value of the portfolio is less than the value of the loan.

On the other hand, if you can hold out for the thirty-year period and everything does work the way you had hoped, you are likely to have a sizable sum waiting in your account. It can be a phenomenal boost to your standard of living.

For many people, the risks are too great to take a chance. Perhaps financial advisers have a different take and can set your mind at ease with respect to the risks. Be critical when talking to them, however. Use the points from this article and even use the spreadsheet to address your concerns. If they don't have legitimate responses to your concerns, this should make you exceedingly cautious.

I anticipate that financial advisers won't like reading this article as it will force them to be more accountable when they present the idea of remortgaging your home. But, what's wrong with accountability, anyway? You'll be more prepared when they present this option to you.You'll know what to expect and you can push back with any concerns you have. You can use this article as your ammunition and let them address each of the items listed.

To try out different scenarios yourself, download the spreadsheet here.