Author Archives: admin

Author Archives: admin

After you start investing, you will eventually want to obtain financial data. You may seek stock price data (popular), or you may look for other types of data, like financial statements. But locating this data is not always easy. I found a great trick that can help you get the data you need. It’s helpful […]

Continue reading

August is often a slow trading month. As such, this post will cover items that are less trading-centric. In this edition, I’ll discuss retiring early, what to do with a lump sum of cash, student loans, robots and investing, homeownership, and finally closing credit cards. Topics Retiring EarlyHow to Invest a Chunk of ChangeWhat to […]

Continue reading

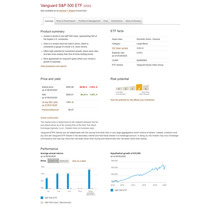

Many investors are considering Exchange-Traded Funds over mutual funds. The expenses are typically lower, and they are more tradeable. It’s like having the benefits of a mutual fund but with the ability to trade like stocks. When think of investing in the S&P 500 index using ETFs they often turn to the Spyder (SPY). But […]

Continue readingWouldn’t it be great to get a pile of cash? It doesn’t happen that often, but it pays to know what to do when it does. Many people would be tempted to spend it. However, with the right approach to investing, you can grow that sum significantly. Learn about a few ways to invest a […]

Continue reading

Have you caught the finance bug yet? It’s a bug that affects experienced investors or traders. As investors gain experience, they realize they can use the power of computing to do the heavy lifting of analysis. If you’re at that point, then this article wil give you your first taste of automation.Why the Need for […]

Continue reading

Have you met FRED? If you haven’t, you are about to when you read this article. FRED is not a person, but a thing. It’s a service provided by your tax dollars that helps you learn about various components of the economy. It is created and maintained by the Federal Reserve of the United States.This […]

Continue reading

When analyzing companies, you’ll often find you need to analyze the competitors of the companies your are considering. It makes sense, as the industry is a factor in your analysis. But when you start your search, you learn why finding competitors is tough. We’ll explore some of the issues in this article, as well as […]

Continue reading

Earnings, especially earnings per share (EPS), are the little darlings of Wall Street. It is something all the financial pundits drool over. When a company announces earnings that are greater than anticipated by analysts, the stock often soars into the stratosphere. This article will debunk the earnings myth and show you why earnings may be […]

Continue readingIt may seem like a strange statement to make on why dividend-paying stocks can be safer, but they can. The way they offer safety, though, is subtle, and will be described in this article. It’s probably not what you think, but it’s still good!Are Dividend Stocks Safer?Dividend stocks, by themselves, aren’t any more safe than […]

Continue reading

By: James Cochrane Updated: January 15, 2020 Investing in hard. Anyone who tells you otherwise is either trying to sell you something or doesn’t know how to invest themselves. If it were easy everyone would be multimillionaires.The dynamics of investing are within reach. It’s just that it takes a lot of time to go […]

Continue reading